See also

Building Renovation Outlook Reports

Tracking trends, EPCs, and national subsidy schemes for residential buildings.

A look back on the new version of EPBD with the Country Energy Demand Forecast scenarios

Get this executive brief in pdf format (free)

In March, EU lawmakers adopted the final version of the Energy Performance of Buildings Directive. This directive is the main instrument to mitigate emissions from the building sector in Europe (which account for 25% of emissions). This directive was anticipated to set the industry firmly on the trajectory towards achieving net-zero targets. However, due to the evolving political landscape, the directive's initial ambitions have been significantly curtailed. This brief reviews the directive's development and evaluates the repercussions of postponing the prohibition on gas boiler sales, employing two sensitivity analyses based on Enerdata's CEDF scenarios1.

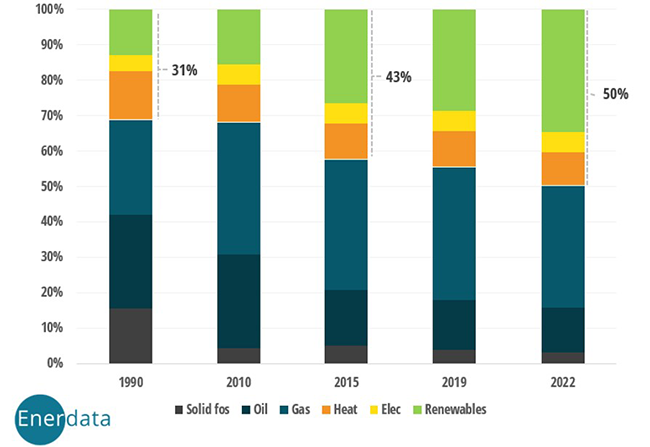

Figure 1 : Share of energies for space heating in dwellings in EU27

Space heating represents 20% of the EU GHG emissions

The European Union (EU) has committed to achieve carbon neutrality by 2050, with an intermediate target of -55% by 2030 compared to 1990. The buildings sector represents more than 25% of the total emissions of the EU emissions, primarily due to the use of fossil fuels for space heating.

Currently, fossil fuels represent around 55% of the final energy consumption for space heating in dwellings in EU27. The share of fossil fuel decreased since 1990 moving from 69% to 50% in 2022.

The share of coal and oil in space heating have moved respectively from 16% and 27% in 1990 to 4% and 11%. But the share of gas increased between 1990 and 2022 from 27% to stabilized to 38%. It remains the main source for space heating. Meanwhile, the use of other energy sources, particularly renewables, has grown substantially in the final energy consumption mix. The share of renewables, including biomass and ambient heat from heat pumps, has risen from 13% to 30%.

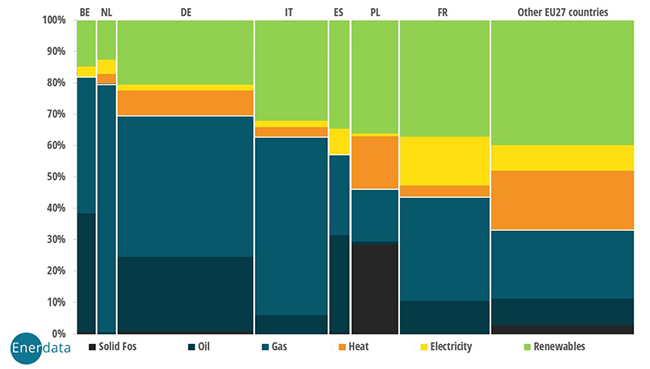

Figure 2: Repartition of the energy consumption for space heating in dwellings by EU country in 2022 (1788 TWh)

Source: Enerdata, Odyssee, Eurostat

The proportion of each fuel used for space heating differs significantly across EU countries, often reflecting the availability of domestic resources. For instance, coal constitutes approximately 30% of space heating in Poland, whereas gas boilers meet nearly all space heating requirements in the Netherlands. In France, electricity is an important energy source for space heating, accounting for about 15% of the total. The diversity of building types, heating systems and climates across Europe presents a significant challenge in the development of a unified policy at the European level.

Since 1990, emissions from the buildings sector have decreased by approximately 30%, according to data from Odyssee. However, to meet its equitable share of emissions reductions, the sector must accelerate its efforts. The principal European policy aimed at reducing buildings sector emissions is the Energy Performance of Buildings Directive, with its latest version being approved in 2024.

The new Energy Performance of Buildings Directive - a focus on the decarbonisation of the existing buildings

The first version of the Energy Performance of Buildings Directive (EPBD) was initiated in the early 2000. Since then, the various versions of the EPBD have imposed numerous efficiency measures on Member States, including the development of energy performance certificates and near-zero energy standards for new buildings.

The latest version of the directive was discussed as part of the Fit for 55 packages presented in 2021. Following extensive discussions and revisions, the final agreement on this latest version of the directive was reached in March 2024.

A directive more focus on existing buildings

If the directive sets emission standards for new residential and non-residential buildings, which will have to reach zero emissions by 2030 (2028 for public owned buildings), a significant portion of the directive is dedicated to the decarbonisation of existing buildings.

Existing buildings must be retrofitted to become zero-emission building (ZEB2) by 2050, meaning that both their emissions and their total annual primary energy consumption will have to comply with maximum thresholds depending on the location of the building.

The directive imposes a target in terms of total energy consumption and renovation. For residential buildings, a consumption trajectory is given (16% reduction of primary energy by 2030, and between 20 and 22% by 2035 compared to 2020) but no indications on renovation. However, the directive states that 55% of this consumption reduction must be achieved by renovating the least efficient buildings.

For non-residential buildings, it is quite the opposite: the rate of renovation is imposed: 16% of the least efficient buildings by 2030, 26% by 2033.

The directive also requires Member States to draw up a National Building Renovation Plan, which will be integrated into the NECP from 2028. The aim is to replace the Long-Term Renovation Strategies with a more detailed framework, including a roadmap of renovation rates for 2030, 2040 and 2050.

A new dimension of this version of the EPBD is the focus put on the phase-out of fossil fuel boilers. The EBPD imposes the removal of financial incentives for fossil-fuel boilers by the 1st of January 2025. And member states are required to produce a plan to completely phase-out of fossil-fuel boilers by 2040.

A directive with limited ambitions

While the overall content of the directive moves in the right direction for reducing emissions, several aspects may be seen as weaknesses in achieving the 2050 goal.

First, the energy consumption reduction targets for residential buildings by 2030 and 2035 are ambitious. However, the requirement that 55% of renovations be focused on the least efficient buildings seems less so, given that the "least efficient buildings" are defined as the 43% worst-performing residential buildings.

Additionally, the directive presents a potential contradiction. On one hand, it mandates that states achieve a zero-emission building stock by 2050. On the other hand, it requires them to develop plans for phasing out fossil fuel boilers by 2040. This dual target could undermine the significance of the 2040 deadline, which is crucial for achieving a 90% reduction in emissions by 2040, a goal currently under discussion.

This directive has been the subject of intense debate between the European Parliament and Member States, with earlier versions of the text being more ambitious on several fronts. Initially, the directive aimed to cover the least efficient 15% of the building stock and proposed phasing out fossil fuel boilers five years earlier than the current version. Some other aspects debated in the framework of the REPowerEU have been watered down, especially the date for an end of stand-alone fossil fuel heaters. The clear signal that has been applied to the car market has been discussed during the development of the REPowerEu plan for fossil fuel boilers, with an end of sales in 2029.

However, this target was ultimately excluded the EPBD. The issue became highly sensitive and sparked significant political debates in several Member States in 2023.

2023: a reduction in ambition to ban fossil fuel heaters

Following the significant increase in heat pump sales across Europe in 2022 and the collective effort to reduce dependency on gas after the Russian invasion of Ukraine, several governments considered setting a phase-out date for fossil-fuel heating systems. However, facing significant opposition, particularly in Germany, many countries backed down.

In Germany, Olaf Soltz's coalition has delayed the date for banning the installation of fossil fuel boilers in buildings from 2024 to 2028. This reversal followed strong public opposition, which the far right has leveraged to gain strength in the polls.

In the United Kingdom, Prime Minister Rishi Sunak postponed the ban on new oil and LPG boilers from 2026 to 2035 for both new and existing buildings. Additionally, the target date for banning gas boilers in new buildings was pushed from 2025 to 2035.

In France, gas-fired boilers have been banned in new single-family homes since 2023, and a ban to multi-family homes after 2025. In 2023, the French government initiated a public consultation on the decarbonisation of buildings, which included the potential prohibition of gas heating installations in existing buildings. In response to public opposition in other European countries, the government decided to not proceed and instead proposed to accelerate the installation of heat pumps.

These shifts in ambition coincided with the debate on the new version of the Energy Performance of Buildings Directive (EPBD) and significantly contributed to its diluted goals.

Analysis – the impact of stepping back the ban in fossil fuel boilers sales

Two sensitivity scenarios were built around our Country Energy Demand Forecast’s Toward Net Zero scenario (TNZ), to assess the impact of introducing -or not- a policy banning the sale of oil and gas boilers in 8 European countries3. In the first sensitivity, the 2029 ban on sales of oil and gas boilers initially discussed in REPowerEU framework is respected when there is no earlier national policy already in place. In the second sensitivity, fossil fuel boilers are still being sold until 2036, with a decline in sales between 2030 and 2036. This sensitivity is closer to what a scenario driven only by the current 2040 EPBD target could look like. It enables us to assess the residual effort required between 2036 and 2040 to reach an actual phase out in 2040.

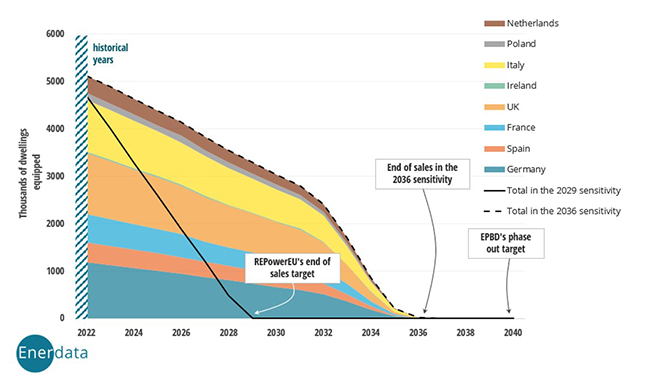

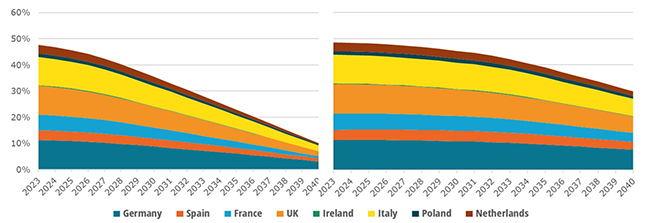

Figure 3 shows the gas boilers being installed in existing buildings in the two scenarios, until 2040. Nearly 27 million additional dwellings are equipped with gas boilers over the whole simulation period in the 2036 sensitivity compared to the 2029 one.

Figure 3: Gas boilers installed in existing residential buildings by country per year, in the 2036 sensitivity - comparison with the 2029 sensitivity (thousand units)

Source: Enerdata, own calculations based on Granular Energy Demand Forecast

In the REPowerEU-compatible sensitivity, even if no policy is implemented to force the actual complete phase out of fossil fuel boiler in 2040, the number dwellings equipped with gas boilers in 2040 is rather low: around 20 million over the 8 countries (i.e. around 10% of the stock), compared to over 75 million in 2029. This 73% reduction is partly due to the hypothesis that sales of gas boilers will fall rapidly after 2023.

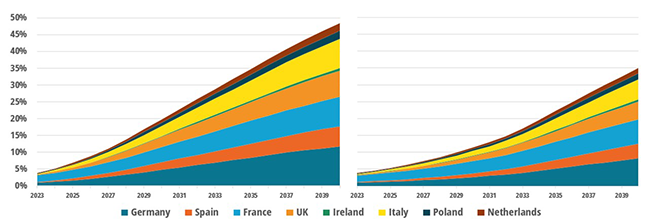

Figure 4: Share of residential buildings heated by gas boilers - 2029 (left) and 2036 (right) sensitivities

Source: Enerdata, own calculations based on Granular Energy Demand Forecast

On the other hand, in the 2036 sensitivity, there are still over 60 million buildings heated by gas boilers in 2040, which only represents a 34% reduction compared to over 90 million in 2029. This also means that, in at least 60 million buildings, gas boilers should have been replaced after their sale and before their end-of-life, between 2036 and 2040. Figure 4 shows the share of the whole building stock in the 8 countries that is heated by gas boilers in the 2036 sensitivity. In 2040, the United Kingdom, Germany, and Italy represent a particularly important part of this share. The relatively slow decrease in gas boilers at the beginning of the simulation is also due to the replacement of oil boilers by gas boilers. The 2036 sensitivity is also naturally characterized by a slowdown in the development of heat pumps compared to the 2029 sensitivity, as it can be seen on figure 5.

Figure 5: Share of residential buildings heated by heat pumps - 2029 (left) and 2036 (right) sensitivities

Source: Enerdata, own calculations based on Granular Energy Demand Forecast

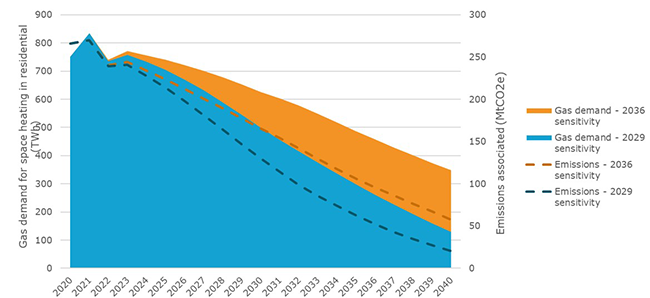

Finally, assumptions such as those used in the 2036 sensitivity could significantly increase the gas demand in the residential sector. It could represent a 10% raise until 2040 compared with the 2029 sensitivity, or an additional 2400 TWh over the 8 countries. This would also mean increasing the cumulated emissions between 2021 and 2040 of space heating for dwellings by more than 560 MtCO2e (+7%).

Figure 6: Gas demand for space heating in residential and emissions associated – comparison of the two sensitivities

Source: Enerdata, own calculations based on Granular Energy Demand Forecast

Conclusion

The evolution of the Energy Performance of Buildings Directive (EPBD) reflects both the progress and challenges in the EU's efforts to decarbonise its building sector. While the directive is a crucial tool aimed at reducing emissions from buildings, which account for a significant portion of the EU's total greenhouse gas emissions, the recent amendments indicate a reduction in its overall ambition. The political debates and the resulting compromises have led to a directive that, while still impactful, seems not in line with the -90% target by 2040 (reaffirmed by the President of the Commission), which requires almost all emissions from buildings to be reduced by that date.

The absence in the text of an end date for the sale of stand-alone fossil fuel heaters, but only a phase-out plan by 2040, could lead to a significant number of gas heaters being installed in buildings. In the sensitivity scenario where the ban is postponed, the number of residential buildings heated by gas boilers remains considerably high, leading to increased emissions and higher energy consumption. It could also lead to the decommissioning of an important number of boilers before the end of their normal life to meet the 2040 target. This can be seen as an over-investment, in a situation where the challenge is how to finance this transition.

Notes

- More details here

- Define as a building with a very high energy performance requiring zero or a very low amount of energy, producing zero on-site carbon emissions from fossil fuels and producing zero or a very low amount of operational greenhouse gas emissions.

- Those countries are the ones that are included in the Country Energy Demand Forecast scenarios, namely: France, Germany, the United Kingdom, Italy, Ireland, Spain, the Netherlands, and Poland.

This analysis has been made in the framework of the update of the CEDF scenarios.

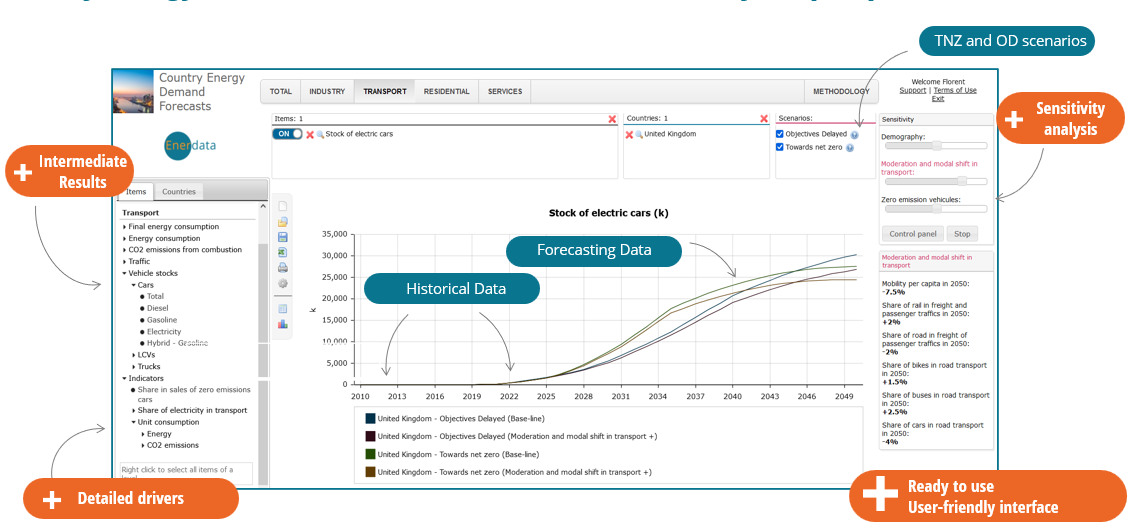

Country Energy Demand Forecast

Country Energy Demand Forecast is an innovative service offering consumption projections to 2050, drilling down to end uses and industrial branches for 8 countries of the European continent: France, Germany, Italy, Ireland, Netherlands, Poland, Spain, UK.

This allows users to track underlying factors throughout the industry, transport, residential and services sectors, as well as the dynamics of future energy demand thanks to a built-in sensitivity analysis to assess the impact of key drivers on energy use. Two scenarios are included in the product.

Towards Net Zero

The scenario assumes that the main EU targets voted on and under discussion have been achieved. People, institutions and companies are very aware of climate change and are committed to finding sufficient solutions to reduce emissions. Research continues to improve technology towards greater efficiency, and disruptive technologies are becoming matures. There is a strong trend towards the electrification of low-temperature heating applications and road transport.

Objectives Delayed

This scenario achieves the set of European climate targets with a delay of 5 to 10 years. The efficiency of technologies continues to improve, but without any significant improvement. Climate change awareness is low, people are not changing their behaviour to limit energy consumption, and Europe misses its net-zero target in 2050.

Detailed Data

- Energy demand forecasts by country up to 2050 with one-year steps

- Forecasts of oil, gas, coal and electricity consumption by sector:

- Industry

- Services

- Transports

- Residential

- Calibration update to consider recent trends in energy demand.

Detailed down-to end-uses: electric vehicles, modal changes in transport, air conditioning in buildings, etc.

User-Friendly Solution

- Intuitive interface accessible via web browser

- Powerful sensitivity analysis with slider to observe instantaneously the impact of key drivers on both scenarios

Access to demand drivers and key indicators

All in one expert solution for all users

- Two scenarios per country.

- Access the underlying assumptions and the reference year data

- Bottom-up modelling methodology

- Explanation of the influence of key drivers

- Assistance from our demand experts

- Data export:

- Default: xls download

- Option: monthly delivery of updated data CSV through FTO

Option: Custom API, development

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis