-

-

Energy and Climate Databases

Energy and Climate Databases- The most comprehensive and up-to-date annual energy database.

- Monitoring of technology providers in H2 supply chain.

- Monthly energy data on key energy markets.

- Monitoring of Hydrogen and Derivatives Projects

- The most reliable and up-to-date power generation database.

- The essentials of LNG trade at your fingertips.

- Global monitoring of new and existing refineries.

- Analyse energy consumption and efficiency trends at world level. Benchmark countries.

- Have your database developed by a recognised expert of both energy and IT.

-

Energy - Climate Forecasts

Energy - Climate Forecasts- Future carbon costs with reliable price forecasts

- Instant access to energy and emissions forecasts.

- Annual projections of wholesale prices up to 2050, based on a 360° approach of the energy markets, enabled by the globally recognised POLES model.

- Wedges module showing a breakdown of the levers enabling to reduce emissions between two scenarios.

- Unique, independent projections of consumption by end-use.

- GHG Marginal Abatement Cost Curves.

- Benefit from proven models to draw your own energy scenarios and anticipate tomorrow’s challenges.

-

Market Intelligence

Market Intelligence- 110 Energy and climate country reports.

- Tracking trends, EPCs, and national subsidy schemes for residential buildings.

- Daily brief covering the entirety of the turbine industry.

- A newsletter to receive the latest updates on evolving technologies and policies.

- Global energy news and analyses curated daily.

- Enerdata’s experts bring you the essentials about your market and competitors.

-

-

-

Market Analysis

Market Analysis- Understanding key consumption trends and drivers across sectors.

- Granular and exclusive insight to address the most pressing business and strategic issues.

- Expertise in strategic and business intelligence, with fine-tuning to the market’s specificities.

-

Energy - Climate Scenarios

Energy - Climate Scenarios- Providing the outlook of an energy commodity in mid to long term time horizons.

- Sector and driver specific energy demand forecasting.

- Assess the evolution of energy prices on the international and regional markets, as well as end-users prices.

- Enerdata guides you through pathways to reach climate targets.

- Supporting local authorities in their decarbonisation strategies.

-

Climate Strategy and Policy Evaluation

Climate Strategy and Policy Evaluation- Cutting-edge quantitative tools and relevant indicators to monitor and evaluate evolutions on worldwide energy markets.

- Analysis of the most cost-effective options to reduce emissions.

- Quantified simulation and analysis of pledges for climate change negotiations.

- Breakdown of carbon markets and evaluation of the climate change impacts on the carbon price.

- Enerdata guides you on the most beneficial policy or investment options.

- Turning climate objectives into concrete action plans.

-

Training

Training- Understand different policy targets and measures on energy efficiency.

- How to measure energy savings?

- Energy Forecasting is a 2 days training to learn to design and interpret energy forecasts.

- Energy statistics training allowing to create energy balance with supply, transformation and consumption and understanding the international energy statistics regulations.

- Initiation to EnerMED level 1is the training to approach on the most powerful energy demand forecasting model.

-

-

Resource Centre

Indonesia Key Figures

- Population:

- 283 million

- GDP growth rate:

- 5.03 %/year

- Energy independence:

- 100%

Data of the last year available: 2024

- Total consumption/GDP:*

- 71.4 (2015=100)

- CO2 Emissions:

- 3.09 tCO2/cap

- Rate of T&D power losses:

- 8.52%

* at purchasing power parity

View all macro and energy indicators in the Indonesia energy report

Indonesia Energy News

View all news, archive your new and create your own daily newsletters only on your topics/countries of interest with Key Energy Intelligence

Indonesia Energy Research

- Indonesia's Energy & Climate Policy Framework: Indonesia has delayed its 23% renewable energy target to 2030 and plans to phase out coal by 2040. The National Energy Council oversees policy, while ESDM manages resources. The electricity sector is opening to private producers, with a focus on increasing renewables. Oil and gas production is being boosted, and coal regulations aim to secure domestic supply. Renewable energy targets and support mechanisms are in place, with biofuels and energy efficiency also being promoted. Climate change mitigation efforts include emissions trading and carbon tax plans.

- Indonesia's Energy Companies: PT PLN dominates Indonesia's electricity sector, while Pertamina leads in oil and gas. Coal production is fragmented among private firms. PT PLN plans to phase out coal plants by 2030, replacing them with renewables. Pertamina also dominates refining and gas supply, with BP and Medco as key players.

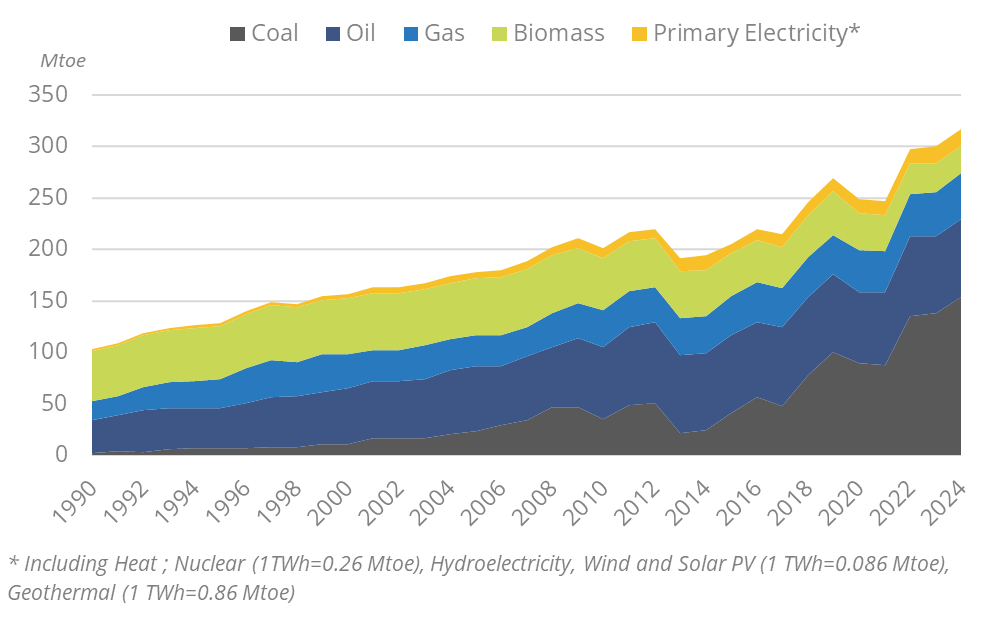

- Indonesia's Energy Supply & Demand: Indonesia's energy mix is dominated by coal (68% in 2024), with rapid growth in coal consumption and a decline in gas exports. Primary energy consumption surged post-2021, reaching 317 Mtoe in 2024. Fossil fuels account for 86.4% of the energy mix, with coal, oil, and gas leading. Electricity generation is also coal-heavy (68%), contributing to high CO2 emissions. Gas and oil sectors face production declines, while renewable energy capacity remains limited.

- Indonesia's Energy Use & Price by Sector: Energy demand in Indonesia has surged since 2021, with industry and transport leading consumption. Oil dominates the energy mix, though electricity's share is rising. Subsidies have fluctuated, with recent reductions in 2024. Prices for electricity and fuel have varied, reflecting global market trends and policy adjustments.

- Indonesia's Issues & Prospects: Indonesia aims to boost renewables to 29% by 2050, with significant investments in solar, wind, and hydropower. Despite coal phase-out plans, new coal plants are being built. Gas and oil sectors face challenges, while CCS and green hydrogen projects are advancing. Transmission infrastructure is expanding to support energy transition goals.

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

A data overview is available in the global energy statistics app

Indonesia Total Energy Production & Consumption

Primary consumption has been increasing very rapidly since 2021 (around 9%/year), reaching 317 Mtoe in 2024. It grew slower in the previous decade (3.3%/year over2010-2019).

Graph: Primary Consumption Trends by Energy Source

Source: Indonesia energy report

Interactive Chart Indonesia Total Energy Production & Consumption

Source: Global Energy & CO2 data

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

View the detailed fondamentals of the market at country level (graphs, tables, analysis) in the Indonesia energy report

Indonesia Oil Production & Consumption

Oil production has declined by 3.5%/year since 2010, reaching 32 Mt in 2024. This decline is due to the depletion of the main fields and the lack of investments.

Crude oil consumption has been decreasing since 2019 (-2.4%/year) to around 45 Mt in 2024; it remained stable around 50 Mt from 2000 to 2019.

Indonesia became a net importer of crude oil in 2012. Net crude oil imports reached 12 Mt in 2024.

Crude Oil Production & Consumption

Source: Indonesia energy report

Interactive Chart Indonesia Crude Oil Production & Consumption

Source: Global Energy & CO2 data

Interactive Chart Indonesia Refined Oil Products Production & Consumption

Source: Global Energy & CO2 data

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

Additionally, for more detailed information on refineries, you can request a sample of our Asia Refineries Dataset

Indonesia Natural Gas Production & Consumption

Natural gas production rose by 5% in 2024, reaching 72 bcm, after decreasing regularly from 2010 to 2023 (-3.4%/year). The Tiung Biru and Jambaran fields in Java began commercial operations in 2022 (1.8 bcm/year). The rapid growth in the country's natural gas production seen in the 90s (6%/year) slowed down over the 2000 decade because of depleting fields (0.6%/year between 2000 and 2008). The production fields are far from the consumption areas, located in Sumatra, Kalimantan, the Natuna Sea, Irian Jaya (western New Guinea), and Sulawesi.

Source: Indonesia energy report

Interactive Chart Indonesia Gas Production & Consumption

Source: Global Energy & CO2 data

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

Additionally, for more detailed information on the LNG trade, you can request a sample of our Asia LNG Trade Dataset

Indonesia Coal and Lignite Production & Consumption

Coal production has been growing very rapidly since 2020 (11%/year on average) reaching 833 Mt in 2024. It grew by 7%/year on average between 2015 and 2019, after very rapid growth over 2000-2013 (15%/year). Indonesia is the third largest producer of coal and lignite.

Exports increased by 6.5%/year from 2010 to 2019. After a 9% decline in 2020, they rebounded by 11%/year starting in 2021, up to 557 Mt in 2024. Indonesia is the largest coal exporter worldwide.

Graph: Coal Production & Consumption

Source: Indonesia energy report

Interactive Chart Indonesia Coal and Lignite Production & Consumption

Source: Global Energy & CO2 data

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

View the detailed consumption trends at country level (graphs, tables, analysis) in the Indonesia energy report

Indonesia Renewable in % Electricity Production

EBTKE, the Directorate General (DG) for New Energy, Renewable and Energy Conservation, focuses on renewables in power generation, whereas the DG of Electricity sets the FiT and the ceiling price for power from renewable sources.

The country targets a 23% share of renewables in the energy mix (excluding traditional biomass) in 2030 in the new KEN of 2024 (15% in 2024); this objective was postponed from 2025 as planned in the KEN 2014 (Regulation No. 79/2014).

Source: Indonesia energy report

Interactive Chart Indonesia Share of Renewables in Electricity Production (incl hydro)

Source: Global Energy & CO2 data

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

Learn more about renewables in the Mini grid Africa & Asia markets for village electrification

Indonesia GHG emissions and CO2 emissions

In its 2022 NDC, Indonesia slightly increased the country's unconditional emission reduction target from 29% in 2030 to 31.89% compared to the BAU scenario. In 2025, the country updated its second NDC for the 2031 to 2035 period, pledging to reduce its emissions by 31.89% (unconditionally) to 43.20% (conditionally) by 2030 compared to a BaU scenario.

The updated NDC aligns with Indonesia's national strategies, such as the Nation's Low Emissions Development Strategies (LTS-LCCR 2050) and the Long-Term Development Planning Document (RPJPN 2025-2045).

Source: Indonesia energy report

Interactive Chart Indonesia CO2 emissions

Source: Global Energy & CO2 data

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

View the detailed consumption trends at country level (graphs, tables, analysis) in the Indonesia energy report