See also

From Policy to Practice: The Development of Renewable Hydrogen in Europe

Get this Executive Brief in PDF format (Free)

In 2020, the European Commission introduced a dedicated hydrogen strategy aiming to achieve the ambitious target of 10 million tons of renewable hydrogen production within the EU by 2030. This initiative gained further momentum with the European Commission’s REPowerEU communication in May 2022, which reinforced renewable hydrogen objectives by adding the goal of importing 10 million tonnes of renewable hydrogen by 2030. However, at the time of their release, no legislative framework had been established to explicitly outline what constitutes this denomination. It was not until February 2023, that the European Commission enacted two delegated acts in accordance with the requirements set forth in the Renewable Energy Directive II.

What do the delegated acts include?

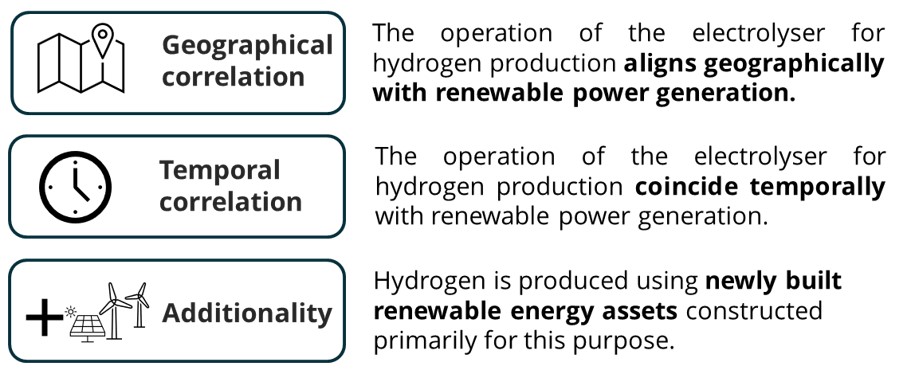

These acts focus on defining the conditions under which hydrogen and hydrogen-based fuels can be considered as renewable - renewable fuels of non-biological origin (RFNBO) within the EU terminology1. The vision outlined in this framework is centred on the production of hydrogen through electrolysis, using electricity from renewable energy sources. In this context, the delegated acts specify three criteria to assess whether hydrogen qualifies as RFNBO: temporal correlation, geographical correlation, and additionality.

Figure 1: Key aspects introduced by the RFNBO legislation

Source: Delegated regulation on Union methodology for RFNBOs

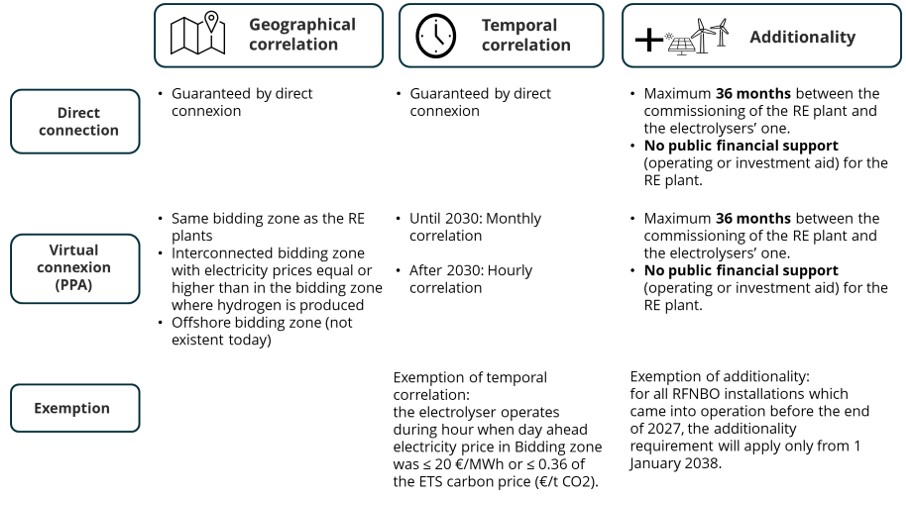

The first two criteria are designed to ensure that hydrogen production occurs at times and locations where renewable electricity is available. The additionality criterion is aimed at preventing electrolytic hydrogen production from monopolising existing renewable power capacities. Different cases are described based on the connection type between the electrolyser and the renewable power plant. This connection may involve a direct link to a nearby power plant, referred to as a direct connection, or a virtual connection in which electricity is sourced through renewables power purchase agreements (PPAs). The first table outlines how criteria are applied based on the connection type for the electrolysis plant.

Figure 2: Criteria application for renewable electricity supply according to RED II delegated acts

Source: Enerdata, analysis based on RED II delegated acts

Note: RE: Renewable Energy; PPA: Power Purchase Agreement

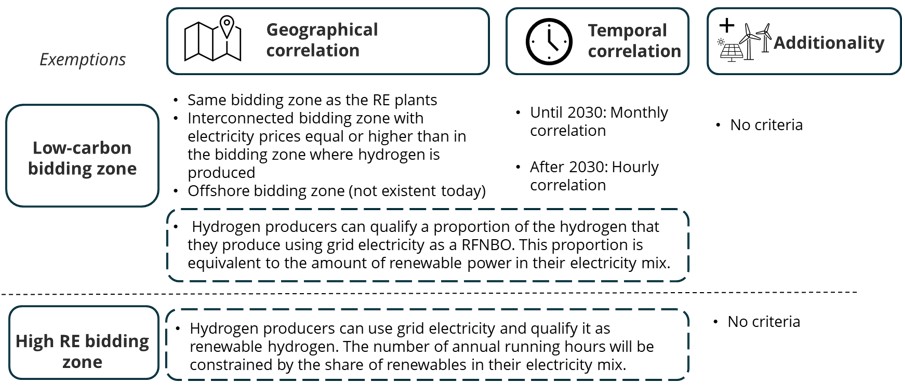

The text introduces exemptions where the criteria above do not need to be strictly followed. Two particular instances are highlighted: bidding zones where the share of renewables exceeds 90%, and bidding zones with a carbon intensity of the grid below 18 gCO2eq/MJ or 64.8 gCO2eq/kWh. The second table elaborates on these specific bidding zones, where the criteria are less stringent.

Figure 3: Specific criteria in RED II delegated acts for two exceptions

Source: Enerdata, analysis based on RED II delegated acts

Note: RE: Renewable Energy; PPA: Power Purchase Agreement

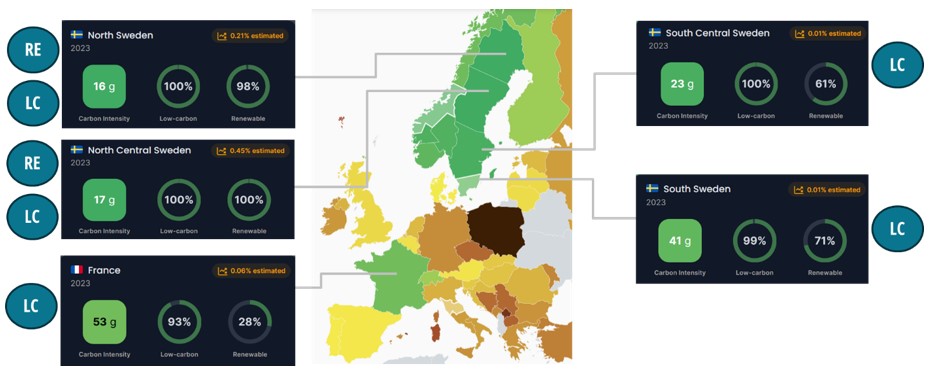

The information provided in the second table highlights two significant advantages for these specific bidding zones. Firstly, there is no obligation to develop additional capacities dedicated solely to hydrogen production. The absence of an additionality requirement allows them to leverage existing renewable capacity, whether subsidised or not. Additionally, there is the flexibility to utilise either partially or entirely grid electricity to source renewable energy. It allows electrolysers to operate using grid electricity without the need for a power purchase agreement (PPA), thereby increasing utilisation rates. These areas are favoured for project development, as they entail fewer constraints in securing electricity supply, facilitating the production of hydrogen that meets RFNBO criteria. Consequently, project developers can produce renewable hydrogen (RFNBO) without the necessity to co-develop or secure contracts for new renewable power capacities. The map below highlights the bidding zones that fall under the scope of one of these two cases in 2023.

Figure 4: Map of carbon-intensity and renewable share of electricity in 2023 in Europe.

Source: Electricity map

Note: The coefficients used by Electricity Maps are not necessarily those used by the States. Detailed methodology can be found in Annex C of Regulation (EU) 2023/1185.

RE: Renewable Energy; LC: Low Carbon

One country that stands out on this map is Sweden, divided into four distinct bidding zones. All four fall into one of the two specific cases outlined below, with the two northern zones meeting the requirement of over 90% renewables share, while the two southern zones have a grid carbon intensity below the required threshold. The bidding zone of France also meets the criterion of low carbon intensity.

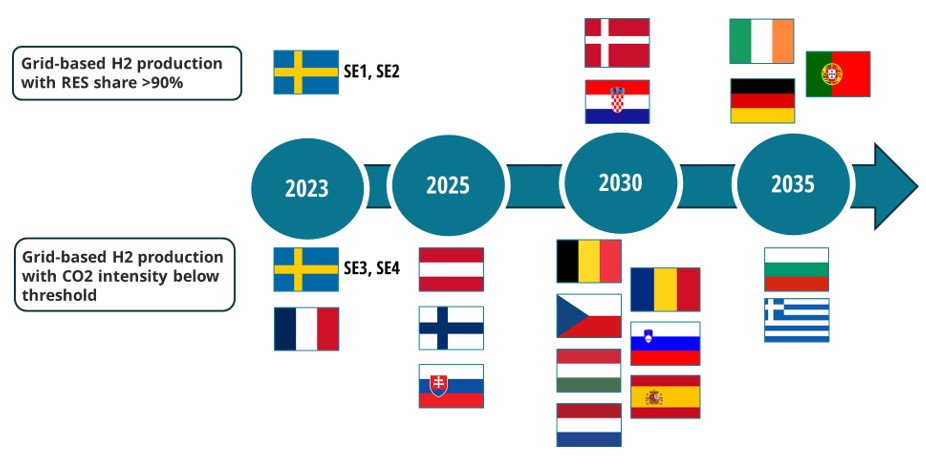

Most EU Member States are expected to benefit from exemptions by 2035

In the coming years, it is anticipated that numerous countries will join these advantageous bidding zones, with power production comprised of over 90% renewables or low-carbon sources. The chart below illustrates EU Member States meeting either of these criteria, as outlined in the EnerBlue2scenario from EnerFuture's energy projection services, which provides a national power mix forecast. According to this scenario, 14 Member States are anticipated to satisfy at least one of these criteria. By 2035, Italy and Poland are projected to be the only two countries not meeting one of the specified criteria.

Figure 4: Timeline of Bidding Zones Completing Low-Carbon or Renewable criteria using EnerBlue scenarios

Source: Enerdata, EnerFuture

Notes to the chart:

Sweden is divided into four bidding zones.

Each bidding zone is represented only once, even if it meets both criteria.

Italy and Denmark are each treated as a single bidding zone, despite being divided into several zones.

The Baltic countries, Malta, Cyprus, and Luxembourg are not included.

When a Member State matches one of the exemption criteria, it can have a direct impact on the electricity supply choices of the national hydrogen projects. Meeting one the criteria tends to encourage the development of grid-connected project3, in contrast to the current trend where most announced projects plan to establish direct connections with newly dedicated renewable power plants. Although there have been minimal changes in project plans recently, the impact of the delegated acts on future connection choices should be closely watched.

A clear definition is not enough to scale-up the hydrogen production market

The definition offered by the two delegated acts offers clarity in a market where most projects remain unsecured. When examining ongoing projects, Enerdata’s hydrogen production database reveals a total of 130 GW of electrolysis projects in the EU expected to be online by 2030, spanning across various stages from concept to feasibility studies, Final Investment Decision (FID), under construction or operational phase. Most early-stage projects focus on dedicated renewable energy sources. However, RFNBO regulations aim to demonstrate that this will increasingly become unnecessary across many EU Member States4. Despite these developments, only 3% of the listed electrolysis capacity in the EU projects has progressed beyond the FID stage, highlighting significant barriers to project implementation and uncertainties regarding off-takers.

Sweden is leading the way in this field, leveraging its extensive renewable energy resources and low-carbon intensity grid. The country accounts for 1 302 MW or 32% of the capacities currently at the FID/construction phase in the EU. The majority of this capacity is attributed to two industrial-scale projects focused on producing direct reduced iron for steel production. These initiatives, which utilise hydrogen produced through electrolysis using grid electricity, are led by H2 GreenSteel (800 MW) and HYBRIT (500 MW) in the northern bidding zones. Both companies have already secured off-take agreements and letters of intent for their low-carbon steel production. H2 GreenSteel and SSAB, the latter representing the HYBRIT consortium, have entered into supply contracts with automotive manufacturers or suppliers such as BMW Group, Mercedes-Benz, Porsche, Scania and Volvo. These examples demonstrate the initial business case for the commercialization of products manufactured using renewable hydrogen, with the commercial vehicle industry actively driving demand for premium steel products.

While the steel sector is at the forefront, similar projects can be observed in refineries and fertilizer production, the two largest consumers of hydrogen globally today. Companies such as Yara and TotalEnergies are developing projects that are initiating the consumption of renewable hydrogen in their respective sectors. A recent call for tenders by TotalEnergies has highlighted the challenges in achieving the Final Investment Decision (FID) stage. Although the company issued a tender for 500,000 tonnes of renewable hydrogen for its refineries, the resulting prices were significantly higher than the anticipated range of 3 to 5 €/kg of hydrogen. Nonetheless, TotalEnergies secured a 15-year agreement with Air Products for the annual supply of 70,000 tonnes of renewable hydrogen in Europe, starting in 2030.

Will these regulations influence the global hydrogen market?

Overall, the European Union's definition of renewable hydrogen has the potential to serve as a global benchmark, particularly as the continent aims to import significant volumes of this fuel. Moreover, the EU stands as the world's first market to establish such regulations, setting a precedent that others may follow. For instance, the eligibility criteria outlined in the Inflation Reduction Act recently introduced by the US Treasury Department align closely with those established by the EU. Additionally, various certification schemes are being utilised or developed by certification bodies, focusing on aspects such as geographical boundaries, chain of custody, system parameters, and CO2 thresholds (kgCO2/kgH2) for hydrogen certification.

The publication of these Delegated Acts has provided clarity on the criteria for renewable hydrogen, while the Renewable Energy Directive III has set specific consumption targets for the industry. The awaited definition of low-carbon hydrogen is expected to offer further clarity, completing the regulatory framework necessary to advance the scale-up of the sector.

KEY TAKEAWAYS

- The EU Delegated Acts establish criteria for ensuring electrolytic hydrogen is produced using renewable electricity. These criteria, temporal correlation, geographical correlation, and additionality must be met for hydrogen and its derivatives to be classified as Renewable Fuels of Non-Biological Origin (RFNBO) under EU regulations.

- The regulatory framework allows exemptions for EU Member States with high renewable energy penetration or low-carbon grids. In these zones, renewable hydrogen production is simplified, removing the requirement to develop additional renewable power solely for hydrogen production and allowing the use of grid electricity to source renewable energy.

- As of 2023, only bidding zones in Sweden and France qualify for these exemptions. Additional EU Member States, including Finland, Austria, and Slovakia, are expected to meet the criteria in the coming years.

- Although the regulation has been approved, most hydrogen projects remain in the early stages. Only 2% of the listed electrolysis capacity in EU projects has advanced beyond the Final Investment Decision (FID) stage, reflecting significant implementation barriers and uncertainties around off-takers.

- Sweden is at the forefront of hydrogen development in the EU, with approximately half of the EU's electrolysis capacity currently in construction phase. This is largely driven by two industrial-scale projects, H2 GreenSteel (800 MW) and HYBRIT (500 MW), focused on producing direct reduced iron for steelmaking. Both projects have secured supply contracts with automotive industry players seeking premium steel products.

Notes:

- The production of hydrogen from the gasification of biomass is at a negligible scale and is not addressed within the scope of this article.

- The EnerBlue scenario is based on the successful attainment of NDCs (Nationally Determined Contributions) and other national commitments for 2030, coupled with sustained efforts beyond that timeframe.

- The definition criteria of an RFNBO is not the only factor influencing the project developer’s choice. In particular, the cost of grid connected electricity versus direct one can encourage the development of direct connection, depending on the project’s location.

- However, a direct connection to a project can be cost competitive, depending on the amount of transport and distribution tariffs that need to be paid by the project owner when signing for a grid connected electricity supply.

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis