In terms of geopolitics and costs, will materials become “The New Fossil Fuels”?

This month, we wanted to share the preliminary results of some ongoing research into the transition to carbon neutrality, or zero net emissions, and its impact on material resources in advanced economies. This research is led by Patrick Criqui, senior researcher emeritus at CNRS and Université Grenoble Alpes, and a member of Enerdata’s expert panel. In light of the IPCC’s recent report, the topic couldn’t be more timely.

We know one, obvious effect the energy transition will have: reducing economic and geostrategic dependence on fossil fuels. But that isn’t the only outcome to prepare for. Dependence will also increase on certain critical materials, including lithium, cobalt, rare earth elements, manganese, nickel, and copper. Increased demand for structural materials, such as cement, steel, and glass will also have to be considered.

Understanding the International Context

The global quantitative impacts of a zero-net-emissions future will be more connected to changes in developing countries and international policies around the world, than to domestic policies in any one advanced economy.

Reduced demand for fossil fuels will likely lead to a drop in their international prices (when ignoring possible cyclical changes and strategic moves by producers – which are unlikely to have long-lasting effects – and any major geopolitical changes).

The root of the materials challenge, then, is mitigating dependence for critical materials on several not-necessarily-stable regions, for example: Chile for its lithium, the Democratic Republic of the Congo for its cobalt, and China for its rare earths. Some observers have gone so far as to ask if we are heading for a war over material resources1.

In assessing these risks, one must consider three distinct factors, each an independent possibility in its own right:

- Studying long-term primary materials markets shows that cyclical supply-demand imbalances come to an end after a market tension induces a price surge and leads to the mining development of less easily accessible deposits (that is, deposits with lower concentrations, perhaps in more difficult to reach locations, which may require advanced mining technologies and, for these reasons, are more are expensive to exploit). These price increases often bring surges in technical progress, which will spread through the industry and may even cause countershocks. (Examples of this abound in the petroleum industry, from offshore drilling in the 1970s, to gas or oil shales in the 2010s.)

- Following a similar line of thinking, if the energy transition continues to gain momentum, it will spur progress and learning effects in low-carbon technologies, which will reduce the material and energy content needed for a given equipment. These are the notable conclusions of several studies2.

- For rare critical materials, which will be used in larger quantities, recycling will likely play an important role, as it already does for some structural materials, such as steel or glass.

Some natural resource economists, such as Jeffrey Krautkramer3, suggest taking all of these potential developments into account leads to a paradox: while renewable natural resources are threatened with exhaustion from overexploitation, at least non-renewable resources are protected by the economic mechanisms of price and markets. This may hold true at least until 2050, while beyond that point, demand stabilization may become essential.

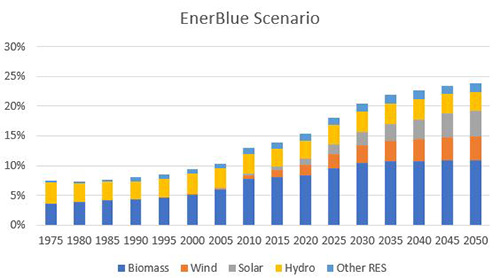

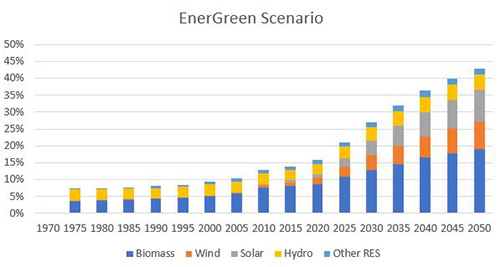

Figure 1: Renewables in Total Energy Consumption for OECD Countries Could Reach Between 24 and 42% — Depending on the Strength of RES Policies

EnerBlue scenario definition:

The EnerBlue scenario, part of Enerdata’s EnerFuture modelling system, explores a world in which currently enforced climate policies are continued, and NDC targets are achieved.

EnerGreen scenario definition:

The EnerGreen scenario, also part of Enerdata’s EnerFuture modelling exercise, envisions a world in which stronger environmental efforts are undertaken, leading to a carbon emission trajectory compatible with a 2°C temperature increase by 2100.

Source: Enerdata - EnerFuture (EnerBlue and EnerGreen scenario)

Impacts on Energy and Material Resources

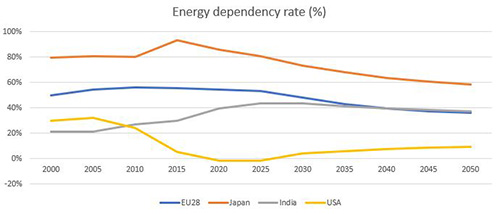

The expected drop in fossil fuel prices (although difficult to predict, as it would result from the timing and intensity of decarbonisation policies at world level) combined with the reduction in fossil fuel use and imports (tending always closer to zero in transitioning countries), should lead to a massive reduction in many countries’ foreign energy spending and dependence.

Figure 2: In the EnerGreen Scenario, Energy Dependency – the Percentage of Energy Imported – Could Decrease, But Regional Variance Remains Significant

Source: Enerdata - EnerFuture (EnerGreen scenario)

But will those reductions be effectively cancelled out by increases in spending, importation, and dependence for strategic materials?

The answer will depend on two factors:

- Any effort taken to develop national mining resources – with all the potential social acceptability problems associated with such a task. These risks will reinforce the necessity of strong recycling policies.

- The development and strengthening of industrial capacities in countries that currently import fossil fuels, for the manufacturing of equipment for renewable energy, electricity storage, and production or conversion of hydrogen. Without these capacities, dependence on primary resources will simply morph into dependence on industrial equipment.

Impacts on Policies and Short-Term Decisions

In the transition from fossil fuels to low-carbon technologies, the strategic priorities are circular economy and recycling of material resources – neither of which had any role in the fossil-fuel-based energy economy.

Therefore, research, development and innovation policies for low-carbon technologies are tasked first with developing the industrial capabilities for the development of the corresponding equipment and then with mastering the fields of materials and recycling, as well as fleshing out any bottlenecks in these systems.

The issue of whether and to what extent to develop national resources, and the potential for exploiting foreign resources, must all be examined from this perspective: How is it possible to avoid becoming dependent on expensive, undependable foreign resources for critical materials in the same way we currently depend on such resources for fossil fuels?

Selected Research Sources

1The War Over Rare Metals,” book by Guillaume Pitron, published January 2018. Excerpt available in French here: https://lemde.fr/2QIjfgG

2Deriving life cycle assessment coefficients for application in integrated assessment modelling,” research paper published in the journal Environmental Modelling & Software, January 2018. Available to download here: https://bit.ly/2ONK416

3“Economics of Natural Resource Scarcity: The State of the Debate,” by Jeffrey Krautkraemer. Published by Resources for the Future, April 2005. Available in full here: https://bit.ly/2qNI9Aa

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis