The future of Russian oil output under sanctions and lower oil prices

Russia remains one of the largest oil producers in the world with 13% of the global oil supply in 2014; it is very important both for consumers and producers to have a vision of the current state and the longer-term prospects for the Russian oil industry development, especially as the current oil price conjuncture creates huge uncertainties. The Russian oil industry is going through a tough time at the moment: natural depletion of the Soviet legacy fields and an unfavourable exploration regime which was formed in the last decade have been substantially limiting production growth since as long ago as 2006. In 2014-2015 these negative factors were compounded by the financial and technological sanctions which impacted the majority of the Russian oil producers, as well as a sharp decline in global oil prices. It was natural to expect a significant reduction in oil production in Russia in this situation. However, statistics show that has not happened. In this article, Enerdata aims to assess which drivers determine Russian oil production dynamics and what production would look like in the near future. Russian oil production dynamics would depend largely on companies’ ability to introduce new fields into operation in due time and the pace of introducing state-of-the-art technologies, which would maintain production levels at the existing fields. We believe that despite the many difficulties, Russia could maintain the current production level in the medium term, within the basic scenario. In the longer term, production decline is virtually unavoidable; however, the rate at which it will happen should not be catastrophic. Moreover, should Russia implement a number of measures, production could even be grown. However, it is important to account for a possibility of a sharper fall in production if the pressure and the sanctions against Russia were to be toughened.

Russian oil output dynamics in 2000s

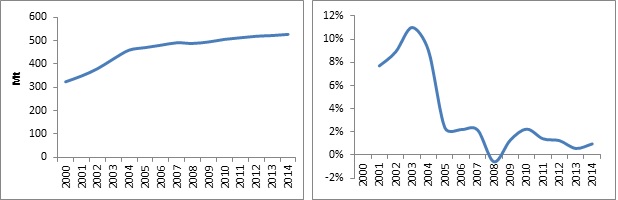

The oil sectors was privatised and deregulated in the early 1990s, according to the concept of ‘‘market reforms’’ promoted by the liberal block in the government. By the late 1990s/early 2000s, following a very contradictory transitional period, all the key Russian oil production assets found themselves concentrated in the hands of private corporations such as Yukos, Sibneft, Lukoil, and Surgutneftegaz – which had become world-class vertically integrated oil companies (VIOCs). All regional markets were divided between these private VIOCs, while state-controlled Rosneft accounted for less than 5% of the country’s production and an even smaller share of the oil products market. In 2000-2005 Russian oil output demonstrated incredible growth – it increased by nearly 50% (Figure 1). This rise was due to a number of the following factors having an impact on the oil industry. Firstly, an increase in global oil prices, secondly, a change of the existing taxation regime away from several specific taxes towards Mineral Extraction Tax and export duties. And thirdly, a substantial expansion of the Russian oil producers’ resource base. The latter was achieved by additional exploration of the fields in the Far East and Eastern Siberia. A general improvement in Russia’s investment climate following the most difficult crises of the 1990s also had an important impact.

Figure 1 : Growth in Russian liquids output

Source: Enerdata, Global Energy and CO2 Data

Starting from 2006 the growth rates slowed down considerably. Over the past 10 years, in 2005-2015 almost no company (apart from Bashneft and of course Novatek on the gas condensate side) have shown any significant organic production growth. At the same time oil production has started to become concentrated in the hands of state-controlled companies such as Rosneft and Gazprom Neft, while just two major private companies (Lukoil and Surgutneftegaz) remained by the end of 2013. This process started in 2003 with the Yukos case when, for the first time, the government showed its increasing interest in controlling growing oil revenues. Introduction of the ‘‘strategic fields’’ concept in 2008 marked a new era in the Russian oil sector, with state-controlled companies getting priority access to the most attractive hydrocarbon resources. Industrial performance supported this paternalistic trend: all major investments are carried out by state-controlled companies, justifying the state’s perception that private companies are focused solely on their profits, rather than on supporting the economy of the country as a whole. This strategy was also strengthened by the personal ambitions of Rosneft’s CEO Igor Sechin, who has been consolidating assets in Rosneft since 2004, turning it into Russia’s national champion. This Executive Brief is taken from an 11-page long analysis. To receive freely the whole analysis please contact us at research@enerdata.net.

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis