From Nord Stream 1 to Power of Siberia 1

This analysis has been written by Thierry Bros member of Enerdata’s Expert Panel and natural gas market expert.

The old gold-plated strategy failed to address new risks

It is important to bear in mind that building an international pipe is the most difficult part of the gas chain as it needs:

- to link on a long-term basis, a seller and a buyer;

- high technology capabilities (especially for deep or long offshore sections);

- high security measures (especially for onshore);

- intergovernmental agreements (and approval by the European Commission of the intergovernmental agreement if signed by an EU country);

- project finance (the pipe needs to be profitable) or high free cash flow for the capex.

This is why we've seen much more pipe Powerpoint presentations (Nabucco and Galsi, for example) than real pipes being built in the past. To address those issues, in the old days, Gazprom strategy was first to contract with buyers on an oil-indexation and then to build the required infrastructure using state-of-the-art technology1, regardless of any other risks that could materialise later. Hence a very resilient infrastructure that can meet peak demand. A few examples of this old mind-set:

The building of Nord Stream 1 in 2010-2012 without taking into consideration the EU third energy package that is now leading this pipe to only be used at 77% of its nameplate capacity2 ;

The development of the Bovanenkovo field and producing pipe decided after signing in 2005-2006 major European export contracts, without taking into consideration the risk in a drop in gas demand in Europe that lead to renegotiations of those contracts (with now a lower oil slope and more spot indexation);

The starting of the South Stream construction in 2012 without again taking into consideration the risk that the EU Commission could ask for third party access, leading to the effective building of the now stranded Russkaya compressor station (US$335m capex for this turn-key contract)3 …

This gold-plated strategy was acceptable in a world where gas demand was always growing and where Gazprom, the export monopoly for Russian pipe gas, was rich enough to bear all those costs. In this old world, Gazprom was investing / paying and the customers were benefiting from secured supply. Today Gazprom has 150 bcm/y of spare production capacity and around 100 bcm/y of spare transportation capacity towards Europe. On top, Gazprom’s dismissal in 2005-2015 of the US shale gas production (by for example not reducing prices in Europe), is allowing liquefaction plants to be built in the US, that could from 2016 compete vs Russian gas…

In our new world, where markets are providing short term pricing, this gold plated strategy is always loss making for the producer who will never benefit from spikes in prices as it has, by construction, a huge spare capacity4 .

Gazprom started to adapt to this new European gas demand by selling gas not only via the traditional long term contracts (with reduced oil-indexation) but also via auctions, via Gazprom Marketing & Trading and via Wingas5 , its 100% owned European utility.

The fact that on 12 August 2016, the signatories of the Nord Stream 2 shareholders’ agreement have withdrawn their application for a merger clearance proceeding in Poland shows that Gazprom takes into consideration new risks (concentration, restriction of competition, antimonopoly laws, etc.). The decision affects the acquisition of the existing project company’s shares by Gazprom’s five Western partners (Engie, OMV, Shell, Uniper and Wintershall). The implementation schedule of the Nord Stream 2 project remains unchanged according to Gazprom 6.

The failure of Lithuania in June 2016 to win compensation from Gazprom over gas pricing at Stockholm's international arbitration court, shows that the Gazprom didn’t violate the contract to supply gas at a fair price7.

After the failed coup in Turkey, Gazprom is now in the process of reassessing all its pipes projects to figure out the best option for the company (on a risk-profit basis). The old assumption that Gazprom will always overinvest in transport capacity to guarantee security of supply to its clients could prove wrong in the future. Security of transport should not be borne only by the supplier. The good old days when European contractors18 where paid by Gazprom to lay pipes for the benefit of European consumers are over; Europe will now also have to share the burden of security of transport.

Finally, in a new Russian world, where competitors (Rosneft, Novatek) are lobbying to access spare export capacity, this strategy is becoming riskier as competitors could convince the State to amend the pipe gas export monopoly, allowing them to use this at the expenses of Gazprom… And it is worth noting that Rosneft’s market cap is now bigger than Gazprom’s one9 and Rosneft is now the biggest contributor to the Russian state budget ahead of Gazprom.

The severe slowdown in Chinese imports reduces the need to fast track a full speed Power of Siberia

In 2002, the Far East program started with Gazprom nomination as coordinator and selected as single gas exporter. The government approval was formally given on 15 June 2007. In May 201410 , Gazprom and CNPC signed the Sales and Purchase Agreement (fully oil-indexed) for gas to be supplied via the eastern route (Power of Siberia gas pipeline). The 30-year agreement provides for Russian gas deliveries to China in the amount of 38 bcm/y. This biggest project on a global scale will lead to US$55bn be invested in the construction of production and transmission facilities in Russia11.

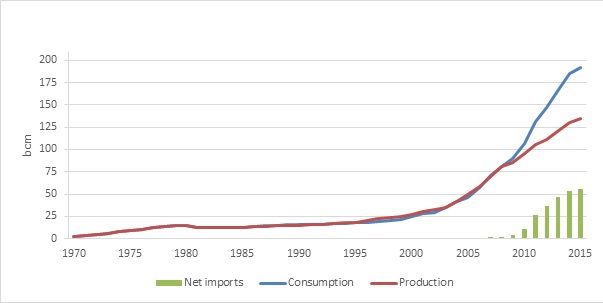

China gas demand has grown by an astonishing 15%/y in 2005-2015 but this growth slowed down in 2014/2015 (+3.3%). In the last 10 years, China has overtaken Mexico (in 2007), Saudi Arabia (in 2008), Canada and Japan (in 2010), Iran (in 2013) and is now the fourth biggest gas consumer after US, EU and Russia. China should in the next 15 years overtake Russia as the third biggest gas consumer but the compound annual growth rate (CAGR) should stay close to the growth rate witnessed last year (3.3%). The production growth did also move down from 11% on a CAGR for the period 2005-2015 to 3.4% in 2014/2015. And more importantly, since becoming a net importer in 2007, China net imports, have grew by 58%/y (2007-2015), but only 3.0% in 2015 year-on-year. This means that the Chinese gas imports forecast done back in 2014 need to be revised down. And the unknown remains the ability at some stage in the future for China to produce its massive shale reserve…

Figure 1: China: net imports are slowing down sharply…

Source: Enerdata, Global Energy and CO2 Data, thierrybros.com

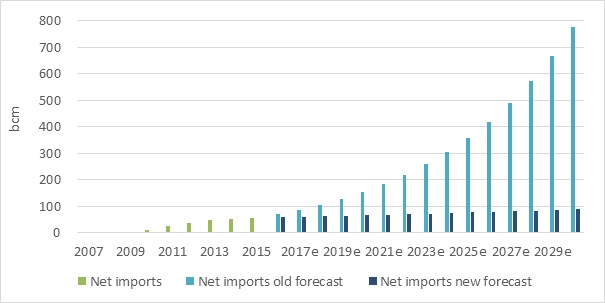

A very basic calculation shows that if we assumed that CAGR of 2007-2015 was to continue for consumption and production, Chinese net imports would have increased by nearly 30 bcm between 2020e and 2021e. If we assume that the new norm is what we witnessed in 2014/2015, then a 30 bcm growth in Chinese net imports will take more than a decade (2020e-2030e). The higher probability is now more on the lower side than on the upper side of those forecasts (and we again stress that we have assumed no major Chinese shale production)…

Figure 2: … and should grow much slower

Source: Enerdata, Global Energy and CO2 Data, thierrybros.com

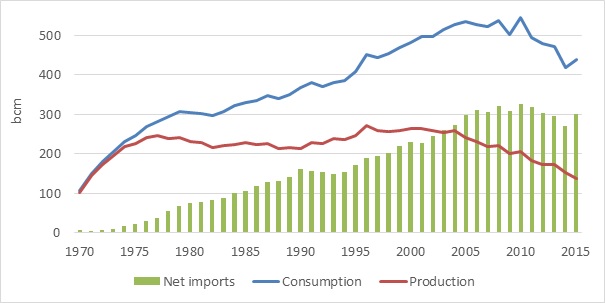

This story (over contracting at too high prices on the eve of a severe downward demand revision) looks similar to what Europe has witnessed in the last decade, where net imports stayed at the same level through the last 10 years (due to a drop in gas demand and a drop in EU production). If history repeats itself then the new norm in China should lead to contracts renegotiations and arbitrations with the aim for the buyer to achieve reduced prices in an oversupplied world. Hence why Gazprom is now looking at expanding the use of gas in China (gas-fired power generation and gas as a vehicle fuel)12 to boost demand.

Figure 3: EU: same level of net imports in 2015 as in 2005

Source: Enerdata, thierrybros.com

As China emerges into one of the most attractive markets, competition for it will be fierce13 . Gazprom has a strong natural advantage over other suppliers due to geographical proximity of its East Siberian resource base. With a lower Chinese net imports growth, not only the Western Route (Power of Siberia 2) is unlikely to be needed anytime soon but the ramp up of the Power of Siberia 1 is going to be very long. Hence why the building of the pipe can be slightly delayed but most importantly the 8 compressors do not need to be operational when the line starts in 2019.

The actual development of the Far East program is now focussing on the Power of Siberia 1. A pipe from the oil & gas producing fields Kovykta to Chayanda (800 km) and then to the Chinese border (Blagoveshchensk) (2,154 km) is in construction. So far 128 km have been laid14.

When visiting the construction site of the Power of Siberia we found interesting that Gazprom was adapting the project investment to the market fundamentals. For example, as gas from the Yakutia and Irkutsk gas production centres (Eastern Gas Program) comes with a high helium concentration (c. 26%), Gazprom decided to separate most of the helium at the Chayanda well head with membrane technology and to re-inject it in the field, to avoid oversupplying the market with helium (a valuable chemical use in space, medicine and for military purposes). At the Amur gas processing plant (GPP) (42 bcm/y capacity), a cryogenic recovery of the remaining helium will be done. The Amur GPP will include the world's largest helium production facility (60 mcm/y). According to Gazprom the full development of the Chayanda field is expected in 2025 with 335 gas and 310 oil wells.

Figure 4: Laying of the Power of Siberia 1 – July 2016

Source: Gazprom, thierrybros.com

One of the most efficient mitigation measures to reduce the Western sanctions impact is Gazprom's continuing effort for technological independence and import substitution. This is meant to increase the share of domestic products in the group's production activities and to facilitate the development of Russian equivalents for imported equipment. Foreign equipment currently accounts for about 5% (with less than 0.1% for pipes) of the total procurements made by Gazprom as it has imposed strict limits on the procurement of non-Russian equipment, works and services. All 8 compressors for this line will be manufactured in Russia.

Gazprom has learned and will be smarter going forward

We can then conclude that:

- Power of Siberia could be operational from 2019 but the ramp-up will take more than 5 years. Gazprom will put on-line the 8 compressors needed to achieve the full capacity during the 2018-2025 timeframe to limit upfront capex spending and to avoid spare capacity (that could lead to Rosneft willing to use it to export gas to China);

- If a price war can take place in the coming years in Europe due to the high spare capacity in Gazprom’s hands, that will not accept huge volumes of US LNG, this is not going to be the case in China post 2020;

- A 16 bcm/y (one line) TurkStream (€4.3bn capex mostly sunk anyway with a formerly disclosed capex €11.4bn for the complete 4 lines) is needed to allow Gazprom to cut the 15 bcm/y that transit via Ukraine to Turkey. This will use the already delivered pipe for South Stream and the actual Russkaya compression station to a landfall at Kiyikoy, on the coast of Turkish Thrace. The intergovernmental agreement should now be fast-tracked by the Turkish authorities to allow for the pipe to be operational before 2020;

- Additional capacity from Russia to Turkey is needed to meet growing Turkish demand (and regional demand). This could come via a second line of the Turkish Stream and/or increased capacity in the Blue Stream compressor from 16 to 19 bcm/y;

- In Europe, by selling gas not only via the traditional long term contracts but also via auctions, via Gazprom Marketing & Trading and via Wingas, its 100% owned European utility, Gazprom has gained flexibility (that was formerly in the hands of the European utilities) and can adapt much faster to any market change15.

- Gazprom (and its partners) will wait for an agreement 16 to fully use Nord Stream 117 with the EU commission before starting Nord Stream 218 construction (€8bn capex project that would rely on equity to cover 30% of its costs and on financing for the rest, with pipes already ordered that should start to be delivered from September19 ). The old assumption that Gazprom will always overinvest in transport capacity to guarantee security of supply to its European clients could prove wrong in the future. Security of transport should not be borne only by the supplier. The good old days when European contractors where paid by Gazprom to lay pipes for the benefit of European consumers are over; Europe will now also have to share the burden of security of transport. The stress test will take place in 1st January 2020 as Russia will not renew on-time the transit contract via Ukraine20 that expires on 31 December 2019, leaving Europe short of Russian gas post 2020e unless a Nord Stream 2 solution is found soon... And the EU Commission and the gas industry have divergent views on the need to secure transit flows via Ukraine.

- By selecting Russian companies, Gazprom is not only reducing its capex and its need of hard currencies but also promoting new suppliers that will be, once Western sanctions are lifted, tough competitors to Western oil & gas service companies as they will be able to provide cheaper, less cutting edge technological but more robust solutions21.

Notes:

1 For Nord Stream 1, the compressors were built by Rolls Royce as this was then the only supplier able to provide this record high compression.

2 The 2 outgoing pipes from Nord Stream 1 are NEL (with a capacity of 62 mcm/d) and OPAL (with 55 mcm/d allowed out of the 97 mcm/d total capacity). This means that Nord Stream is limited to a maximum of 117 mcm/d out of a total 151 mcm/d or 77% on an annual level.

3 South Stream capacity was 63 bcm/y. Gazprom has frozen its investment in Russkaya station. The construction of the second compressor station to support South Stream was terminated.

4 That’s why the EU Commission is always pushing for spare capacity as it increases security of supply and caps upsides in prices.

5 Wingas was founded in 1993 by the BASF subsidiary Wintershall and Gazprom. In 2015, Gazprom took over all Wintershall’s shares and Wingas became a wholly owned Gazprom subsidiary.

6 Pipes have already been ordered and should be delivered in September 2016. A potential theoretical solution could be for Gazprom to own the pipe until it enters European waters and to leave the ownership to European companies for the European part of it…

7 A fair price takes into account the level of competition. In a poorly competitive market, the producer should be able to achieve a higher price than in a highly competitive market. Hence the willingness of the EU Commission to increase competition in all energy markets for the benefit of the households. In 2015, after the opening of the Lithuania regas terminal, Gazprom responded by discounting the price of its gas by 23%, showing that competition pushes Gazprom to adapt. A full report on “How to get more fair gas prices?” done by Sund Energy in February 2015 is available on the Energy Community website https://www.energy-community.org/portal/page/portal/ENC_HOME/DOCS/40544…

8 Rolls Royce for compressors, Saipem for offshore laying, etc.

9 In August 2016, Rosneft and Gazprom respective market capitalisation were RUB3,7tn and RUB3,2tn and Rosneft is now the first contributor to the State budget, ahead of Gazprom.

10 On the day of signing the contract in May 2014, Brent was 110US$/b

11 http://www.gazprom.com/press/news/2014/may/article191451/ we expect this capex to be massively reduced due to the Rubble devaluation since May 2014

12 http://www.gazprom.com/press/news/2016/july/article279404/

13 China has not abandoned plans to increase capacity of the East-West line which deliveries Central Asian gas to 80 bcm/y from 60 bcm/y.

14 With a 400km target laid by end 2016.

15 Since Q3 15, Gazprom price is each quarter has been back above NBP Month Ahead (on a quarterly average).

16 Potential solutions could be: auctioning 34 mcm/d (12 bcm/y) gas at the beginning of the Opal pipeline (but auctions were not very successful) or auctioning the remaining capacity on Prisma (and Gazprom bidding for this).

17 Fully used, Nord Stream 1 is a profitable infrastructure. By curbing use, the EU is putting profitability of this pipe at risk. The same would be true for Nord Stream 2.

18 Nord Stream 1 (like offshore pipes bringing gas from Algeria, Libya and Norway) was supposed to be an upstream pipe carrying gas from the Shtokman field. Nord Stream 2 (like South Stream) is a transport infrastructure that will have to meet stringent EU regulations. Any request of Third Party Access as soon as an offshore pipe enters European waters de facto kills the project (technically and economically). Potential solutions from the EU side could be for Nord Stream 2: selling gas in Russia or allowing Rosneft to use part of the pipe. Both options are fiercely opposed by Gazprom. Alternatively, if neither the EU nor the Russian regulations can apply to a single piece of infrastructure, then the last solution is to go back to an intergovernmental agreement dedicated for Nord Stream 2.

19 According to Gazprom’s (Q2 16 conf call), the spent capex so far is €400m and it is expected to reach €600m or €700m at the end of 2016.

20 Even the 2011 Belarus solution (ie Gazprom buying the 13 bcm/y pipe (8 bcm/y to Lithuania and 5 bcm/y to Poland) can still lead to problem as seen recently in Q3 16 when Belarus asked for a further discount in the Russian gas prices formula (to be now calculated in RUB and not in USD any longer).

21 This is exactly what oil & gas companies are looking for in today’s world. “The price tag for developing a field on the Norwegian shelf has declined by an average of more than 40% since the autumn of 2014. The biggest savings on these projects are a result of altered development solutions. The second largest reduction is within drilling and wells, which on average accounts for around 30% of the overall field development costs. This is due to the decline in rental rates for drilling rigs, and also that the companies are planning wells that can be drilled faster. The actual drilling operation has also become more efficient. Investments in pipelines and cables are also expected to decline significantly. This is a result of falling prices for materials, and choosing different routes. Simplified development solutions and less costly materials will yield more reasonably priced modifications and adaptations of facilities where the oil and gas from new developments will be taken in and processed.”

http://www.npd.no/en/news/News/2016/Development-costs-cut-by-nearly-hal…

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis