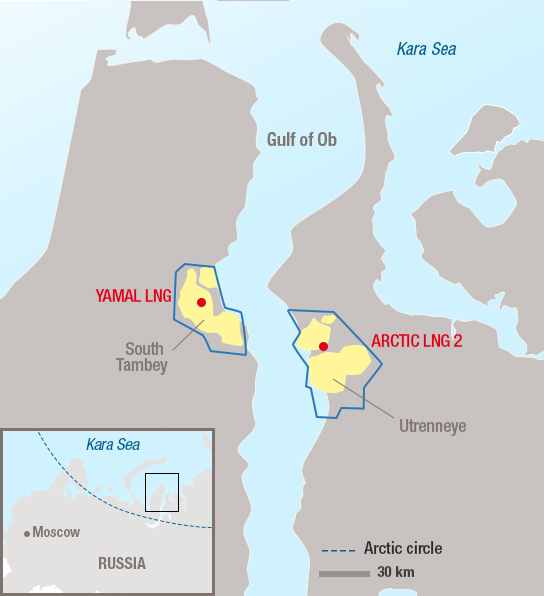

French oil and gas company Total has signed a sales and purchase agreement (SPA) with the Russian independent oil and gas producer Novatek for the acquisition of a direct 10% participation interest in the Arctic LNG-2 project on the Gydan Peninsula (Russia). Total already owns a 19.4% stake in Novatek (60% in Arctic LNG-2), which means its overall economic interest in the project will be approximately 21.6%. In case Novatek chooses to reduce its participation below the 60% threshold, Total will then have the possibility to raise its direct share up to 15%. The transaction is subject to regulatory approvals and will be closed by the end of the first quarter of 2019.

Arctic LNG-2 will consist of three liquefaction trains of 6.6 Mt/year each (total capacity of 19.8 Mt/year). The final investment decision is expected to be taken in the second half of 2019, with the first train expected to start up by the end of 2023. The engineering and construction (E&C) contract for the project was awarded to the Italian oil and gas industry contractor Saipem and its Turkish partner Renaissance Construction (Rönesans Holding) at the end of December 2018. The project is expected to unlock more than 7 Gboe of hydrocarbon resources in the onshore Utrenneye gas and condensate field.

The agreement also stipulates that Total will have the opportunity to acquire a direct interest ranging between 10% and 15% in all Novatek's future LNG projects to be located on the Yamal and Gydan peninsulas.

Source: Total

Interested in Global Energy Research?

Enerdata's premium online information service provides up-to-date market reports on 110+ countries. The reports include valuable market data and analysis as well as a daily newsfeed, curated by our energy analysts, on the oil, gas, coal and power markets.

This user-friendly tool gives you the essentials about the domestic markets of your concern, including market structure, organisation, actors, projects and business perspectives.

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis