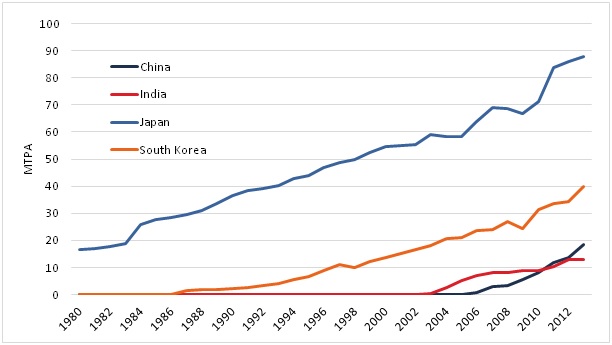

Enerdata is launching a new LNG Market Monthly report and as part of this initiative we have put together a forward-looking paper named “Natural Gas Trading Hub in Asia-Pacific”. The paper describes the latest development and trends and what a Gas Trading Hub may signify for Asia. Will Asia have one day cheap gas prices? After the United States and the European Union, can there be a United Asia to lower the gas price? Procuring competitively priced gas and establishing a regional price indicator has become a critical concern for the governments in the Asia-Pacific. After bringing its new LNG terminal on stream in May 2013, Singapore has announced its ambitious aim of becoming a natural gas trading hub in the Asia-Pacific. In September 2013, Japan and India considered the option of joint tenders to procure LNG at a competitive price and to bring down their soaring import bills. Suffering from huge losses due to expensive LNG imports, Japanese government announced in April 2014 to move away from ‘zero nuclear’ policy in the new Basic Energy Plan. The decade long history of the gas deal signed in May 2014 between CNPC and Gazprom shows the importance of natural gas price in the gas contract negotiations. LNG importing countries like Japan, China and India have expressed their concern about high LNG import prices and argued about developing an Asian price index for natural gas. Many buyers in the Asia-Pacific economies have expressed interest in moving towards a regional gas market indexed price (or gas-on-gas competition) from an oil-indexed system for pricing the imported gas. In 2013, Asia accounted for 75% of the global LNG demand while Europe and North America accounted for only 24 percent. Middle East consumed the remaining 1%. In the global context, short term and spot LNG trade volumes have also increased from around 5% in 2005 to approximately 27% of the total LNG trade. Figure 1 shows the LNG imports for China, India, Japan and South Korea from 1980 to 2013. Japan is the largest market for LNG and China and India are catching up fast. However, nothing is certain in the LNG market. No one can predict the level of the spot prices. It is highly unlikely that spot prices in future will remain at levels of US$18-19/MMbtu after Japanese nuclear restarts and China-Russia deal that has locked 38 bcm of Chinese demand to Russian supply. How the Australian projects that have costs around 2 000-3 000 US$/ton of LNG will see themselves in this ‘new demand scenario’ will be interesting to watch. The ‘new demand scenario’ will affect the LNG trading opportunities as well as price levels in the Asia Pacific region and LNG trading companies that were relying on massive Asian demand need to rethink their strategy.

Figure 1: LNG imports for China, India, Japan and South Korea from 1980 to 2013

Source: Enerdata, Global Energy & CO2 Data and Enerdata, LNG World database

Please contact us at asia@enerdata.net if you would like to receive your free copy of the 8 pages paper.

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis