-

-

Energy and Climate Databases

Energy and Climate Databases- The most comprehensive and up-to-date annual energy database.

- Monitoring of technology providers in H2 supply chain.

- Monthly energy data on key energy markets.

- The most reliable and up-to-date power generation database.

- The essentials of LNG trade at your fingertips.

- Global monitoring of new and existing refineries.

- Analyse energy consumption and efficiency trends at world level. Benchmark countries.

- Have your database developed by a recognised expert of both energy and IT.

-

Energy - Climate Forecasts

Energy - Climate Forecasts- Instant access to energy and emissions forecasts.

- Strategic, annual wholesale price projections backed by Enerdata's energy modelling expertise and our globally recognised POLES model.

- Wedges module showing a breakdown of the levers enabling to reduce emissions between two scenarios.

- Unique, independent projections of consumption by end-use.

- GHG Marginal Abatement Cost Curves.

- Benefit from proven models to draw your own energy scenarios and anticipate tomorrow’s challenges.

-

Market Intelligence

Market Intelligence- 110 Energy and climate country reports

- A newsletter to receive the latest updates on evolving technologies and policies.

- Global energy news and analyses curated daily.

- Enerdata’s experts bring you the essentials about your market and competitors.

-

-

-

Market Analysis

Market Analysis- Understanding key consumption trends and drivers across sectors.

- Granular and exclusive insight to address the most pressing business and strategic issues.

- Expertise in strategic and business intelligence, with fine-tuning to the market’s specificities.

-

Energy - Climate Scenarios

Energy - Climate Scenarios- Providing the outlook of an energy commodity in mid to long term time horizons.

- Sector and driver specific energy demand forecasting.

- Assess the evolution of energy prices on the international and regional markets, as well as end-users prices.

- Enerdata guides you through pathways to reach climate targets.

- Supporting local authorities in their decarbonisation strategies.

-

Climate Strategy and Policy Evaluation

Climate Strategy and Policy Evaluation- Cutting-edge quantitative tools and relevant indicators to monitor and evaluate evolutions on worldwide energy markets.

- Analysis of the most cost-effective options to reduce emissions.

- Quantified simulation and analysis of pledges for climate change negotiations.

- Breakdown and analysis of carbon markets.

- Enerdata guides you on the most beneficial policy or investment options.

- Turning climate objectives into concrete action plans.

-

Training

Training- Understand different policy targets and measures on energy efficiency.

- How to measure energy savings?

- Energy Forecasting is a 2 days training to learn to design and interpret energy forecasts.

- Energy statistics training allowing to create energy balance with supply, transformation and consumption and understanding the international energy statistics regulations.

- Initiation to EnerMED level 1is the training to approach on the most powerful energy demand forecasting model.

-

-

Resource Centre

Nigeria Key Figures

- Population:

- 219 million

- GDP growth rate:

- 3.25 %/year

- Energy independence:

- 100%

Data of the last year available: 2022

- Total consumption/GDP:*

- 81.3 (2005=100)

- CO2 Emissions:

- 0.49 tCO2/capita

- Rate of T&D power losses:

- 15.8%

* at purchasing power parity

View all macro and energy indicators in the Nigeria energy report

Nigeria Related News

View all news, archive your new and create your own daily newsletters only on your topics/countries of interest with Key Energy Intelligence

Nigeria Related Research

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

A data overview is available in the global energy statistics app

Total Energy Consumption

Consumption per capita was 0.8 toe in 2022 (more than 40% higher than the average for Sub-Saharan Africa). Electricity consumption per capita is relatively low in comparison to neighbouring countries and reached 120 kWh/hab in 2022 (2.8 times lower than the average for Sub-Saharan Africa).

Since 2012, total consumption has increased at an average of 1.7%/year to 168 Mtoe in 2022.

Interactive Chart Nigeria Total Energy Consumption

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

View the detailed fondamentals of the market at country level (graphs, tables, analysis) in the Nigeria energy report

Crude Oil Production

Oil production is falling due to declining investments, unplanned outages due to aging infrastructure and poor maintenance, crude oil theft, and pipeline sabotage. Since 2010, it has halved (-52% or -6%/year) to 61 Mt in 2022. The output is a third lower than the Nigeria's OPEC quota for 2022 (88 Mt). In 2022, Nigeria lost its place as the largest African oil producer, surpassed by Algeria (65 Mt). Its oil production remains higher than those of Angola (55 Mt) and Libya (54 Mt).

The country is promoting the exploitation of fields located in the deep and very deep offshore.

Interactive Chart Nigeria Crude Oil Production

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

Additionally, for more detailed information on refineries, you can request a sample of our EMEA Refineries Dataset

Oil Products Consumption

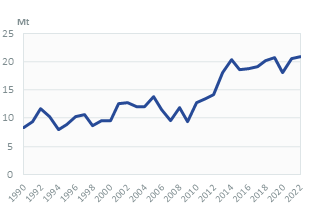

Since 2014, oil product consumption has been relatively stable, at around 20 Mt/year. Previously, it rose by 17%/year between 2009 and 2014.

Transport is the main consuming sector, accounting for 90% of total oil product consumption (77% in 2010), followed by residential and services (6% in 2022, compared to 15% in 2010).

Graph: OIL CONSUMPTION (Mt)

Graph: OIL CONSUMPTION BREAKDOWN BY SECTOR (2022, %)

Interactive Chart Nigeria Refined Oil Products Production

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

Additionally, for more detailed information on refineries, you can request a sample of our EMEA Refineries Dataset

Natural Gas Consumption

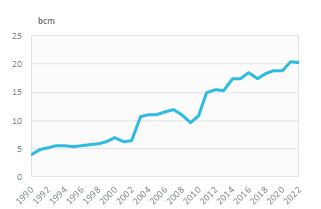

Gas consumption remained stable in 2022, at 22 bcm, after a rapid increase between 2009 and 2021 (by around 7%/year, including +8% in 2021).

The industry sector absorbed 38% of gas consumption in 2022 (up from 14% in 2010); 34% is used for power generation (48% in 2010) and 28% for the oil and gas sector ("others", 38% in 2010).

Graph: NATURAL GAS CONSUMPTION (bcm)

Graph: GAS CONSUMPTION BREAKDOWN BY SECTOR (2022, %)

Interactive Chart Nigeria Natural Gas Domestic Consumption

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

Additionally, for more detailed information on the LNG trade, you can request a sample of our EMEA LNG Trade Dataset

Coal Consumption

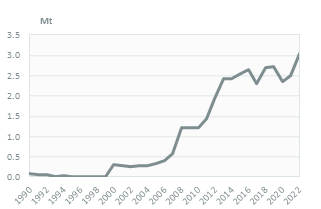

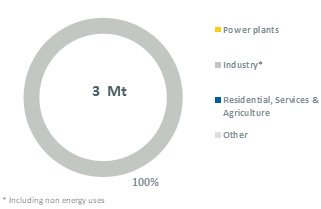

Coal consumption is marginal (less than 0.1 Mt in 2022) and is exclusively used in the industry sector.

Graph: COAL CONSUMPTION (Mt)

Graph: COAL CONSUMPTION BREAKDOWN BY SECTOR (2022, %)

Interactive Chart Nigeria Coal and Lignite Domestic Consumption

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

View the detailed consumption trends at country level (graphs, tables, analysis) in the Nigeria energy report

Power Consumption

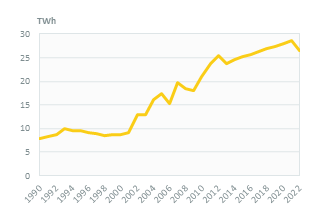

Electricity demand fell by 7% in 2022 to 26.5 TWh. Previously, electricity consumption showed much slower growth than before, following the fall in economic growth with 3%/year over 2013-2021, compared to around 9%/year between 2000 and 2012).

Graph: ELECTRICITY CONSUMPTION (TWh)

Renewable in % Electricity Production

In the ETP (2022), renewables are expected to account for 40% of capacity in 2030, totalling 17 GW (2.1 GW in 2022), and 96% in 2050 with 248 GW. The power sector should reach carbon neutrality by 2050.

The National Renewable Energy and Energy Efficiency Policy (2022) includes a "30:30:30" scheme that plans to add 30 GW of power capacity by 2030, with renewables contributing 30% of the country's energy mix.

Interactive Chart Nigeria Share of Renewables in Electricity Production (incl hydro)

Benefit from up to 2 000 up-to-date data series for 186 countries in Global Energy & CO2 data

CO2 Fuel Combustion/CO2 Emissions

The updated NDC (2021) set an unconditional GHG emission reduction target of 20% below a BAU scenario by 2030 and a conditional target with international support up to 47% (i.e. a level of 244 MtCO2eq for the conditional target compared to a BAU level of 453 MtCO2eq). In addition, Nigeria pledged to reach net-zero emissions by 2060.