In a context of rocketing oil prices and still on-going climate negotiations, this article presents an analysis produced with the POLES model on the underlying interactions between oil and CO2 markets.

The Enerdata Global Energy Forecasting team designed energy scenarios for EDF. Based on some of these forecasting scenarios produced with the globally recognized POLES model, Enerdata has jointly published with EDF an analysis of the interactions between the oil market and CO2 prices. The main conclusions of this study have been presented in March 2012 during a “Friday Lunch Meeting” organized by the Chaire Economie du Climat in Paris (in French only).

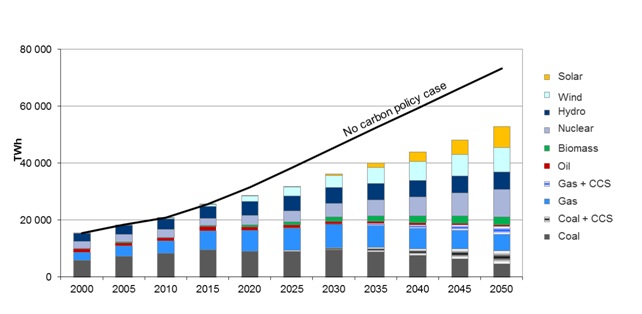

The objective of this presentation was to highlight the interactions between the oil and CO2 prices. First, an assessment of CO2 prices induced by different greenhouse gases emission reductions targets was carried out, with an estimation of the impacts on our future energy mix. A particular focus was brought on power production and the key role of low carbon-emitting technologies in this sector: nuclear, wind, solar, carbon capture and storage.

The robustness of these forecasts to key parameters like GDP growth in emerging economies or a scarcity of oil resources was also studied. The impacts of these alternatives assumptions on oil and CO2 markets were quantified and the interactions between the markets revealed. We concluded with a wider scope on the overall mitigation costs and on the consequences of the implementation of an ambitious climate policy on the oil and gas import/export bills.

Power production at a world level, ambitious carbon target

Publication is in french

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis