The gradual shutdown of pipeline gas exports to the EU

GET THIS EXECUTIVE BRIEF IN PDF FORMAT

Before invading Ukraine, Russia progressively initiated a comprehensive strategy to limit gas exports. Taking advantage of being EU’s #1 supplier, Gazprom and the Kremlin used the gas market to put pressure on European governments. The action plan was multi-tiered. In 2021, gas supplies were gradually reduced and rerouted to avoid passing through Ukraine and Poland. As the conflict escalated, gas supplies to Europe fell sharply and financial sanctions were applied accordingly. On September 26th, 2022, Nord Stream 1, the biggest pipeline in terms of volumes of gas delivered, was sabotaged in the Baltic Sea. This marked an abrupt loss of supply for Europe. Today, the Kremlin appears weaker than a year ago, but it has not yet abandoned its gas strategy. Despite EU sanctions, Gazprom wants to develop a hub in Turkey to maintain its position in the European gas market.

This report analyses the factors triggering and accelerating the gas market upheaval, namely the strategy of limiting Russian gas exports. Initiated in early 2021, this strategy has progressively intensified and diversified, leading to double-edged consequences.

Natural gas, Russia’s gold

As of 2020, Russian gas reserves were estimated at 37.6 trillion cubic meters, a fifth of world reserves. According to British Petroleum1, this represents 59 years of exploitation at current production levels. This volume is much higher than those of the USA (14 years) or Australia (17 years), but far from those of Turkmenistan (230 years), Iran (128 years), or Qatar (144 years), which are adopting a less intensive production strategy.

Most natural gas production is concentrated in Western Siberia, particularly in the Yamal Peninsula in the country’s far north. The Arctic region has also been massively exploited by Russia over the last 10 years. Gas is transported via a vast network of pipelines connecting Russia to Europe and Eastern Asia (figure 1). In 2021, 84% of exports were delivered via pipeline, with Europe receiving 69% of total exports.

In terms of revenue, gas and oil sales accounted for 45% of the Russian federal budget. High hydrocarbon prices generated a trade balance surplus of $122 billion in 2021, and $227 billion in 2022. As a comparison, the trade balance was $65 billion in 2019.

Figure 1: The pipeline network between Russia and Europe

Source: Forbes

Gazprom’s strategic moves on gas transit before the invasion of Ukraine

More than just a fuel, a geopolitical weapon

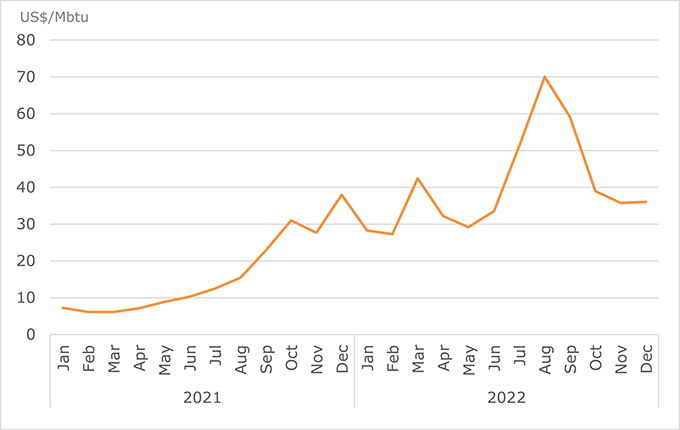

The invasion of Ukraine had a major impact on the European gas market, with surging prices in mid-2022. However, Russia had already initiated a strategy to disrupt the market and put pressure on European governments at an earlier stage. In 2021, gas production from Gazprom (of which the government owns 50%) increased sharply, by nearly 14%, to reach 515 billion m3 (bcm). In December 2021, CEO Alexey Miller admitted that Russian gas storage facilities were 83% full. Although Gazprom could supply significant volumes of additional gas to EU countries, it only met its minimal contractual commitments. Hence, the EU accused Russia of market manipulation and being responsible for soaring prices.

In response, Russian authorities blamed the Europeans, asserting that soaring prices were the direct consequence of European leaders’ willingness to turn away from long-term contracts and increase spot purchases. This communication suggested that Gazprom, by limiting its exports, was seeking to demonstrate the unreliability of the spot alternative.

Kremlin’s spokesman Dimitri Peskov stated: “They (the Europeans) prefer to focus on spot supplies, but it is precisely the spot market that leads to such an unbridled rise in prices. Our company (Gazprom) and Russia are fulfilling their contractual obligations to European consumers 100% and more.”

Figure 2: Natural gas average import border price in Europe

Sources: Enerdata, EnerMonthly

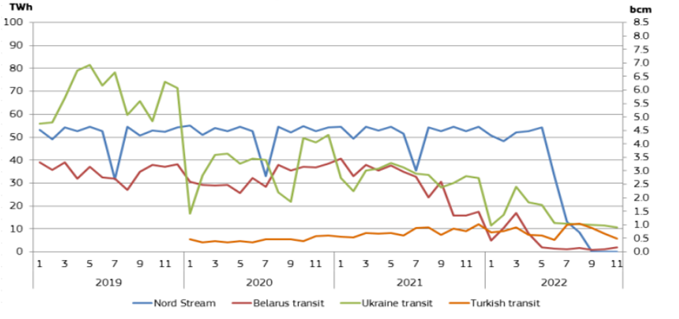

Gas transit re-routing and export reductions to Europe

Early in 2021, Gazprom favoured gas transit through Nord Stream and Turkish Stream to bypass Ukraine and Poland. Over the year, Russian exports to China via Power of Siberia rose from 4.1 bcm to 10.4 bcm, and exports to Turkey increased by 63% compared to 2020. At the same time, pipeline flows to the EU reached 137 bcm, which is 7% higher than in 2020, but 16% lower than in 2019 (the last year without pandemic, geopolitical or economic issues). While Nord Stream’s flow remained steady at 4.6 bcm per month, the Yamal pipeline (which crosses Belarus and Poland) was largely underused. The flow rate reached a 7-year low in November and December 2021, falling to 1.5 bcm per month. Since 2020, there has been no binding contract for a minimum capacity to Europe through the Yamal pipeline. In the second half of 2021, Gazprom was reluctant to commit additional transport capacity on the Ukrainian route, delivering just the minimum contracted volume.

Export reduction was extended at the end of 2021. Over the last four months of 2021, Gazprom exports to Europe fell from 58.2 bcm in 2020 to 44.7 bcm (-24% yoy), even though the supply in 2020 was already low due to the Covid-19 pandemic. On October 13th 2021, despite high prices, trading was definitively suspended on Gazprom’s Electronic Sales Platform (ESP).

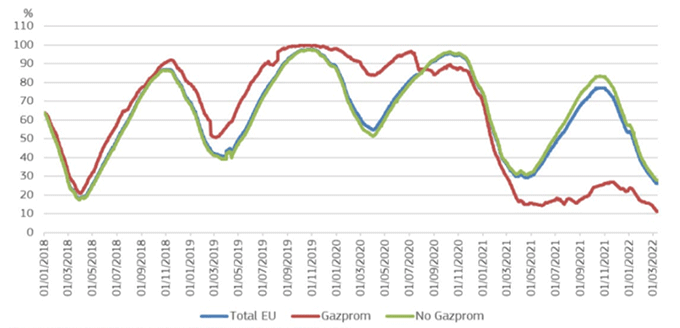

Maintaining low gas reserves as leverage

In December 2021, despite having gas storage facilities 83% full, Gazprom maintained European gas stocks at low levels, which is counterintuitive in a context of growing natural gas demand and production. This strategic shift was founded on two objectives: undermining the LNG alternative, and increasing revenues by driving prices upward.

In October 2021, peak European gas stocks were 17pp lower than in 2020, and 14pp lower than the 2016-2020 average. Approaching the winter season, the average level of gas storage was only 74%. However, Gazprom-controlled stocks in Europe were only filled to 22% of their capacity, while record amounts of gas were injected into Russian storage facilities. As exports continued to decline during the last two months of 2021, EU reserves were left at a much lower level than usual over the winter. Overall, Gazprom’s strategy is not rational from an economic perspective, leaving little doubt as to its geopolitical motives.

Figure 3: Difference in the filling rates of Gazprom controlled storages and other storages

Source: JRC Calculations, based on Gas Storage Europe AGSI+ data

Rise of tensions following diversification strategy in the aftermath of conflict escalation

Timeline of events following the invasion: Russia intensifies its strategy amidst EU sanctions in 2022

February 24th: Russia army invaded Eastern Ukraine.

February 27th: Ursula Von der Leyen announced that EU and G7 partners decided to freeze Central Bank of Russia’s assets. Russia lost access to $300bn of its $640bn in foreign exchange reserves.

March 23rd: Putin announced that payments for Russian gas imports by “hostile” buyers must be made in roubles from April 2022. Moreover, foreign currencies must be converted exclusively via the Moscow Interbank Currency Exchange (MICEX), the main rouble exchange platform. This manoeuvre was designed to protect MICEX from financial sanctions, making it essential for all transactions and immune to sanctions, since it would lead to an interruption of gas supplies.

End-March: Gazprom attempted to transfer control of its subsidiary Gazprom Germania GmbH to a shell company in Russia. This operation was blocked by the German authorities and the company was placed under the supervision of the German Federal Network Agency.

May 10th: Ukrainian network operator GTSOU declared that it could no longer handle the Sokhranivka supply, justified by its loss of control over the gas infrastructure in Lugansk region. Immediately afterwards, Gazprom closed the main Soyuz pipeline and hence transit through the Sokhranivka hub. Denying GTSOU’s allegations, Gazprom refused to reroute the flow towards the Soudja entry point. Initially, the contract between Russia and Ukraine provided for a volume of 40 bcm per year transiting through Soudja and Sokhranivka. Subsequently, Ukraine’s public gas supplier, Naftogaz, accused Gazprom of not fulfilling the “ship-or-pay” contract, an allegation that was rejected by the Russian company. However, in 2022, the volume transiting through Ukraine has been estimated at only 20.3 bcm.

May 11th: Russia imposed sanctions on 31 gas corporations, most being branches of Gazprom Germania GmbH, whose gas deliveries were suspended. To deal with the economic consequences, Germany nationalized Gazprom Germania GmbH on November 14th. In addition, in response to Polish sanctions, Russia added the owner of the Yamal pipeline, EuRoPol, to the list of companies sanctioned, thus ceasing gas transit through Poland.

May 18th: The European Commission presented Repower EU, a plan to be free from Russian fossil fuels by 2030. The emphasis was on three aspects: supply diversification, energy savings, and deployment of renewable energies. An objective to cut gas consumption by 15% between August and November 2022 was established following the supply crisis. This target was exceeded, with a reduction of 20.1% (Eurostat).

The sabotage of Nord Stream, a turning point that killed pipeline gas supply

Back in 2021, the Nord Stream pipeline running through the Baltic Sea was functioning at its maximum capacity of 165 mcm per day. The pipeline’s throughput accounted for 40% of European gas imports by pipeline (15% of EU’s total natural gas imports, including LNG).

In June 2022, Nord Stream’s flow fell sharply to 67 mcm per day due to a non-respect of the rouble payment requirement, according to Russia. A month and a half later, following annual maintenance and turbine shutdowns, the volume delivered was only 30 mcm. Gazprom justified this by a maintenance backlog and malfunctions detected, which remains questionable to this day. On August 31st, Gazprom paused Nord Stream for 3-days maintenance. The pipeline ceased functioning from that day on, before being destroyed on September 26th by sabotage using explosives. The EU accused Russia of this sabotage and vice-versa. To date, the perpetrators remain unidentified.

Figure 4: Monthly EU imports of natural gas from Russia by supply route

Source: Based on data from the ENTSO-G Transparency Platform

Nord Stream’s brutal stoppage had major consequences for national suppliers, who were forced to turn back to spot markets, buying at much higher prices and being subjected to substantial financial losses. In Germany, Uniper (who furnished a third of domestic consumption in 2021) was on the verge of bankruptcy, recording a net loss of €40 billion, the highest loss ever for a German company. This company was finally rescued by the German state with a giant €200 billion deal. Overall, the closing and sabotage of Nord Stream caused an estimated supply loss of 28.5 bcm in 2022. The impact exceeded north-west market boundaries, with most Gazprom customers in Europe receiving smaller volumes than were contractually agreed. The sabotage heightened tensions between the EU and Russia, and member states feared gas supply outages during the winter.

Russia has not given up on the European market

Novatek exported more LNG to Europe than ever before

While Gazprom limited its exports, the main Russian LNG supplier, Novatek, did not. The EU in fact imported 30% more LNG from Russia (15% of EU’s global LNG imports) in 2022 than the year before. Hence, Russia overtook Qatar as Europe’s second-largest LNG supplier. The USA remained the largest LNG supplier with 41% of EU’s imports, with supply skyrocketing from 22 bcm in 2021 to 56 bcm in 2022.

In 2022, LNG exports in Russia reached 45 bcm (25% of the country’s gas exports), 75% of which went towards Europe, the rest being delivered to China.

In the EU, Lithuania has already banned Russian LNG. In the wake of plans made by Germany and the Netherlands to get rid of Russian LNG, the EU is working on strategic alternatives. Outside the EU, the UK has already prohibited LNG imports from Russia.

Banning Russian LNG is a risky decision for European countries. On the one hand, this may lead to another surge in spot prices, with a significant negative impact for gas-dependent member states. On the other hand, such a ban would have little impact on Russian revenues since Yamal LNG exports are already exempt from export duties and mining taxes, unlike pipeline exports. What remains certain is that Russia will have to deal without Western technologies, a key asset for its gas sector.

Russia aims at creating a new hub in Turkey to avoid EU sanctions

In October 2022, Putin started talks with Turkey about the creation of a gas hub. The purpose is to hide the origin of the gas that European buyers are purchasing from Turkey. The country has a capacity of 129.5 bcm per year, far beyond domestic demand (57 bcm in 2021). It also benefits from a large pipeline network with inbound connections from Russia and routing facilities to Europe and CIS countries. Moreover, Turkey is already equipped with the infrastructures needed for a hub creation, making it a major strategic anchorage for the Kremlin. In December 2022, President Erdoğan and Gazprom CEO Alexey Miller discussed the proposition and agreed on the hub creation in the Thrace region, at the Bulgarian border. The hub is expected to be commissioned between 2023 and 2024. Therefore, Turkey will become the privileged route for Russian gas transport to bypass the usual Polish and Ukrainian routes.

EU member states are reliant on the Turkish market to diversify gas supplies, so they have no leverage over Turkey. However, Russia’s capacity to send more gas to Turkey could be compromised by technological and geographical issues: Fully rerouting Nord Stream’s flow appears unrealistic, and the Black Sea is a war zone, which implies the deployment of massive financial and military means to secure the area. In March 2023 the Kremlin admitted the complexity of the project, which “cannot be implemented without time delays, or technical issues”, unlike what Putin asserted in October 2022.

CONCLUSION

Prior to the invasion of Ukraine, Gazprom initiated a strategy to limit the EU’s gas supply. The giant gas company simply filled its minimum contractual duties, with no further volumes sold, despite a growing demand from the EU. The strategy evolved as the conflict intensified. The Russian government got directly involved in the supply outage to Europe by imposing payment in roubles, and by sanctioning European subsidiaries of Gazprom, such as Gazprom Germania. Gradually, the supply through Ukraine and Poland diminished, while Nord Stream operations stopped entirely due to a sabotage. European providers were forced to rely on spot markets causing tremendous financial losses. This will lead to legal confrontations between Gazprom and its customers. The company’s strategy led to the largest decrease in production it has ever recorded. Nevertheless, the losses in production were offset by surging prices, granting historically high revenues to Gazprom ($127 bn).

As a substitute for Russian gas, Europe imported massively from Norway (pipelines) and the USA (LNG). However, Russia has not given up on the European market. They kept an important LNG market share with Novatek, who did not curb exports, and Moscow agreed with Ankara to create a hub in Western Turkey which would reroute its gas flows to Europe, making them untraceable.

Overall, Europe managed to tackle wintertime with high gas reserves, but they incurred high costs to attract LNG carriers at the expense of Asian countries. Uncertainty remains for next winter, since global demand should increase sharply as we expect China to be more active on the market.

This Executive Brief stems from an analysis by Enerdata, the French Institute for International and Strategic Affairs (IRIS) and Cassini for the French Ministry of Defence (full report available in French here).

Notes

1 BP Statistical Review of World Energy 2021

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis