Power grids and market integration as a milestone for energy security and transition

ASEAN is composed of 10 countries, namely: Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. With a combined population of nearly 680 million inhabitants and an average GDP growth rate of 5%, energy demand is surging to sustain economic development. The region presents highly heterogenous countries in terms of size, economy, political system, and market structure. More than ever, it appears that joining forces for power market integration could be beneficial for all of them. Diverging interests with institutional and technical hurdles make it a tough challenge, however.

Notwithstanding the region’s deep reliance on fossil fuels, the last few years have seen renewable energy grow at very fast pace. ASEAN possesses one of the highest potentials for renewables. From geothermal resources in Indonesia and the Philippines, the vast river network in Mekong countries, to the favourable solar exposure in many locations, the potential is vast. In this context, energy security is among the biggest challenges of ASEAN countries’ development. Cross-border energy trade is key to meeting the increase in energy demand, by allowing infrastructures to be built where they are most efficient. Connectivity enables better renewable power integration by taking advantage of resource location and complementarities between the countries. Nevertheless, it implies deep transformations of power systems and generation patterns./em>

This report delves into the ASEAN electricity market characteristics and provides insights on the ASEAN Power Grid, a key initiative for the region’s power supply and energy transition.

Heterogenous power mix and domestic markets, overall fossil fuels dominance

Economic development and power generation remain dependent on fossil fuels

Southeast Asia has experienced substantial economic growth since the beginning of the century. ASEAN recorded an average GDP growth of 5% over the last ten years. Electricity consumption followed a similar pattern, with growth exceeding 6-7% per year in some countries, such as Vietnam. Indonesia is by far the largest economy in the region, with a nominal GDP of $1,319 billion in 2022. Estimates suggest that the country could even become the 5th largest economy in the world by 2050. Vietnam, the Philippines, Singapore, Malaysia, and Thailand are also strong economic drivers for the region’s development, with GDP ranging between $400-500 billion in 2022. In per capita terms and welfare, Singapore remains the only developed country in ASEAN while the others are emerging rapidly. On the other hand, Brunei, Lao PDR, Cambodia, and Myanmar are much smaller economically.

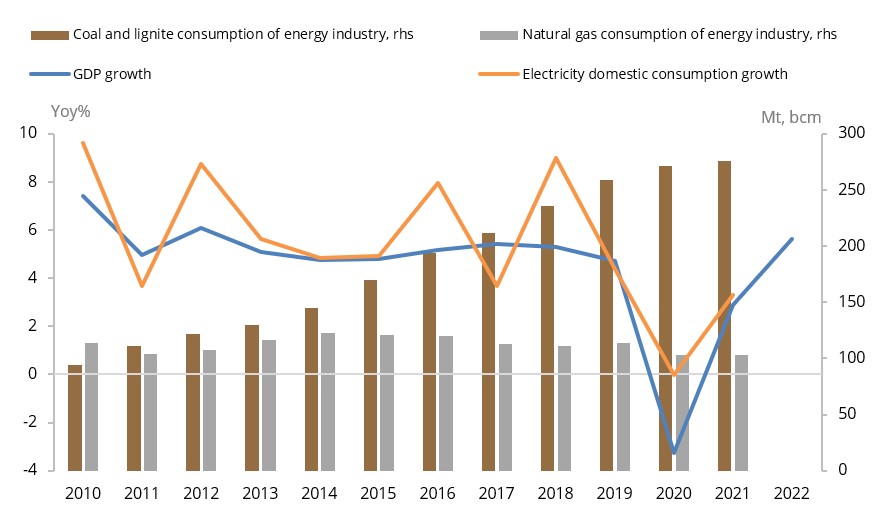

Despite their very different economic profiles, most of ASEAN countries share a common trait: fossil fuels dependence and a high carbon intensity. Coal, gas, and oil combined represent 80% of the region’s primary energy consumption. Oil products alone account for 45% of total final consumption, as they are heavily used in industrial processes and road transports. Electricity production largely relies on coal in Indonesia and the Philippines, while natural gas dominates the power mix in Thailand and Singapore. Overall, natural gas consumption in the energy sector has remained relatively steady in ASEAN since 2010. Meanwhile, coal consumption continued to grow and reached 275 Mt in 2021 (Figure 1). It has even accelerated since the signing of the Paris Agreement in 2015 (all ASEAN members have ratified the agreement).

Hence, the share of fossil fuels in energy consumption has further increased over the last decade in ASEAN as a whole. Nevertheless, there has been a rapid development of renewables in recent years, and some ASEAN countries already have a high share of decarbonised energy in their power mix.

Figure 1: Coal consumption is still growing to feed the energy demand

Source: Enerdata, Global Energy & CO2 data

Electricity demand is high, so is the potential for renewables

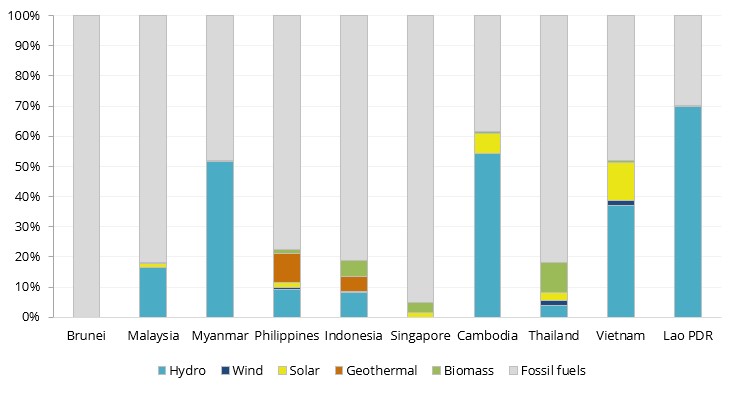

ASEAN has witnessed a significant surge in electricity demand. Indonesia stands as the largest electricity consumer in the region, with a final electricity consumption of 316 TWh in 2022. While fossil fuels dominate ASEAN power mix (accounting for 76%), hydroelectricity infrastructures are well developed in the region, providing 17% of the electricity. Other renewables account for the remaining 7% of the electricity production.

Except for Singapore and Brunei, due to their size and lack of disposable resources, ASEAN countries boast significant potential for renewable energies. Hydropower resources are among the world’s largest thanks to vast networks of rivers, particularly the Mekong and its tributaries in the northern ASEAN countries. Myanmar, Cambodia, Thailand, and Vietnam also exhibit strong solar irradiance, with average annual rates ranging from 1500 to 2000 kWh/m2 and potential capacity factors exceeding 20%. Moreover, Vietnam and the Philippines show substantial opportunities for offshore wind power due to their long coastlines with favourable wind speeds.

As depicted in Figure 2, some ASEAN countries produce a decent share of their electricity from renewable sources, especially hydroelectricity, contributing to more than half of power generation in Myanmar and Cambodia, and up to 70% in Lao PDR. Over the past seven years, six countries (Malaysia, Indonesia, Cambodia, Thailand, Vietnam, and Lao PDR) have roughly doubled electricity production from renewable sources. Noticeably, solar power generation has skyrocketed in Vietnam due to a very high increment of capacities since 2019. Solar capacity climbed from 105 MW in 2018 to 18.5 GW in 2022, making Vietnam the 7th global producer of solar energy. Additionally, biomass and geothermal energy stand as important resources in Southeast Asia. Biomass accounts for 5% and 10% of the power production in Indonesia and Thailand, respectively. Similarly, geothermal energy represents another 5% share of the Indonesian power mix and up to 9.6% in the Philippines. The two countries rank 2nd and 4th in global geothermal energy production due to tectonic activity and a favourable temperature gradient. Lastly, despite a reasonable potential, wind projects are almost non-existent in ASEAN so far, apart from a few farms in Thailand, the Philippines, and Vietnam.

Figure 2: Power generation by energy source in 2022

Source: Enerdata, Global Energy & CO2 data

Degrees of openness within domestic markets vary

ASEAN member states exhibit diverse electricity market structures. Brunei, Cambodia, Lao PDR, and Myanmar rely mostly on vertically integrated models and state-owned utilities. In contrast, Indonesia, Malaysia, Thailand, and Vietnam have introduced some level of competition through private independent power producers. However, state control remains prevalent in transmission and distribution. These nations operate under a single-buyer wholesale market, often with regulated retail tariffs that might not cover all end-consumer delivery costs, necessitating government financial support for utilities.

Among ASEAN countries, competitive electricity market structures are fully present only in Singapore (wholesale competition) and the Philippines (wholesale competition with partial retail competition). Vietnam is also striving to establish a market platform for electricity.

Acknowledging the diverse policy, regulatory and legal frameworks across ASEAN is crucial. As this report delves into the initiatives of ASEAN power market integration, especially the ASEAN Power Grid, the heterogeneity of domestic markets is important to keep in mind. Particularly, designing regional power connectivity and cross-border trade requires a certain level of harmonization.

Enhancing connectivity and market integration through the ASEAN Power Grid initiative

Background, achievements, and current situation

The ASEAN Power Grid (APG), first designed in 1997 under the ASEAN Vision 2020, aims to connect power grids across southeast Asian nations through cross-border transmission lines and standardized markets. The objective is to “enhance energy connectivity and market integration in ASEAN to achieve energy security, accessibility, affordability and sustainability for all”. Endorsed in 2003 and reinforced in 2007, the initial stage focused on utilizing resource diversity and economies of scale to reduce power system expenses.

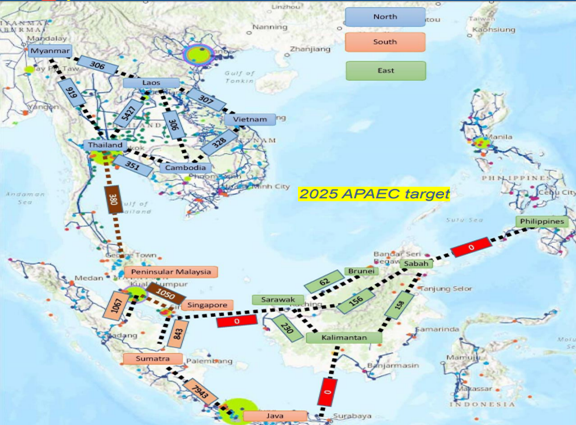

By segmenting ASEAN into three subsystems and identifying 16 interconnection projects, the APG has made partial progress, achieving approximately 7,000 MW of interconnections among member states. In November 2020, the 38th ASEAN Ministers on Energy Meeting endorsed the second phase (2021-2025) of the ASEAN Plan of Action for Energy Cooperation (APAEC). The plan aims to “accelerate energy transition and strengthen energy resilience through greater innovation and cooperation”, the APG initiative being at the core to further enhance cross-border power systems. The grid extension target is depicted in Figure 3.

Yet, persistent challenges stem from different readiness levels among member states, necessitating alignment in technical specifications, financing models, and regulatory frameworks. The APG is key to cater to the region's energy needs, seeking to facilitate cross-border electricity trade while fostering economic development.

Figure 3: ASEAN Power Grid connections

Sources: UNESCAP, ASEAN Centre for Energy

From bilateral connections to multilateral trade and renewable power integration

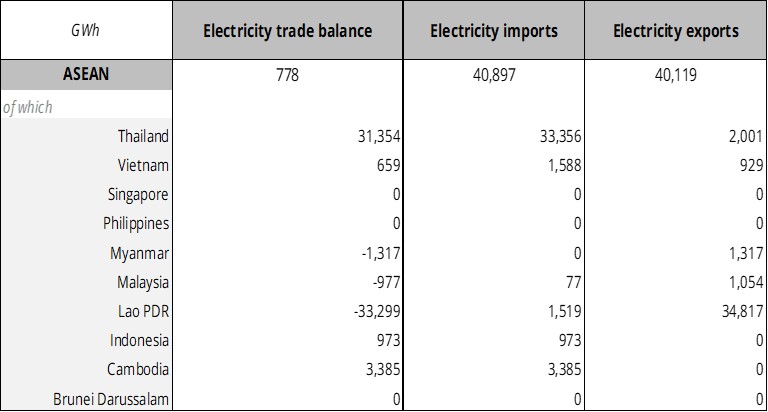

To date, most cross-border electricity trade has relied on bilateral contracts involving one-way flows. Progress in ASEAN power trade has altogether been relatively slow, except for Lao PDR, which has significantly increased its electricity exports. Thus, the current decade marks a pivotal moment for further achievements regarding cross-border electricity trade in ASEAN.

The structure of electricity trade shown in the Table underscores the prevailing regional dynamics. Until 2021 and apart from a few trade lines between Indonesia and Malaysia in Borneo, electricity trade predominantly occurs in the northern part of ASEAN. Lao PDR leads electricity exports by far, accounting for 87% (35 TWh) by selling a considerable portion of its hydropower production to Thailand, Vietnam, and Cambodia. Myanmar and Malaysia are also net exporters, although their traded volumes are less significant. Conversely, Thailand stands as the primary importer, receiving 33 TWh, with a proportion of it being redirected to neighbouring countries.

Table: Structure of electricity trade, 2021

(+/-) A negative trade balance indicates that the country is a net exporter.

Source: Enerdata, Global Energy & CO2 data

A significant milestone was achieved in June 2022 with the transmission of 100 MW of hydropower from Lao PDR through Thailand and Malaysia to Singapore. This project, known as the Lao PDR–Thailand–Malaysia–Singapore Power Integration Project (LTMS-PIP), serves as a pilot to foster multilateral links and develop renewable power transmission.

The development of the ASEAN Power Grid involves intricate tasks in the construction of transmission facilities and the establishment of electricity trading mechanisms. Power trade in ASEAN is gradually moving from bilateral connections to a more integrated network involving renewable sources.

Tackling challenges and embracing opportunities

Singapore and Thailand as transmission hubs, Lao PDR as a key supplier

Due its geographical location and economic size, Thailand is poised to serve as a central hub for electricity trade between the northern and the southern regions of ASEAN. Greater flows should transit from Lao PDR or Vietnam to Indonesia and Singapore, by the end of the decade. Aligned with the LTMS-PIP objectives, Singapore may also emerge as a strategic platform for power trade. Leveraging its robust business environment and institutional stability, Singapore has the potential to evolve as a regional hub for power trade, connecting with Indonesia, the Philippines, and the northern part of ASEAN.

On the supply side, with approximately 80% of its electricity generation exported, Lao PDR has asserted its stance as a key power supplier. More recently, the country signed extended purchase agreements to export 9,000 MW of power to Thailand, 6,000 MW to Cambodia, and 5,000 MW to Vietnam by 2030.

Electrifying to cut emissions while sustaining economic development

Transformations in energy consumption patterns need to occur in ASEAN, with every sector being part of the equation. While the share of electricity in final energy consumption reaches 36% in the residential sector and 25% in the industry, it remains lower than 1% in the transport sector, akin to most regions globally (as a comparison, it is only 2% in the EU). Since the Paris Agreement in 2015, global CO2 emissions increased by 7.2%, nearing 38 Gt in 2022. In ASEAN, CO2 emissions increased by over 20% during the same period. In relative terms, ASEAN countries contributed to 4.1% of global emissions in 2015. This share raised by 1p.p. reaching 5% of in 2022. Indeed, emissions per capita remain significantly lower than those in Western economies, as ASEAN accounts for 5% of emissions while being home to 8.5% of world’s population. Nevertheless, the rapid economic growth and the resultant surge in emissions pose a significant challenge of transition and adaptation. ASEAN countries now face the dual challenge of sustaining GDP growth while concurrently advancing in energy transition. Electrification plays an important role in this pursuit.

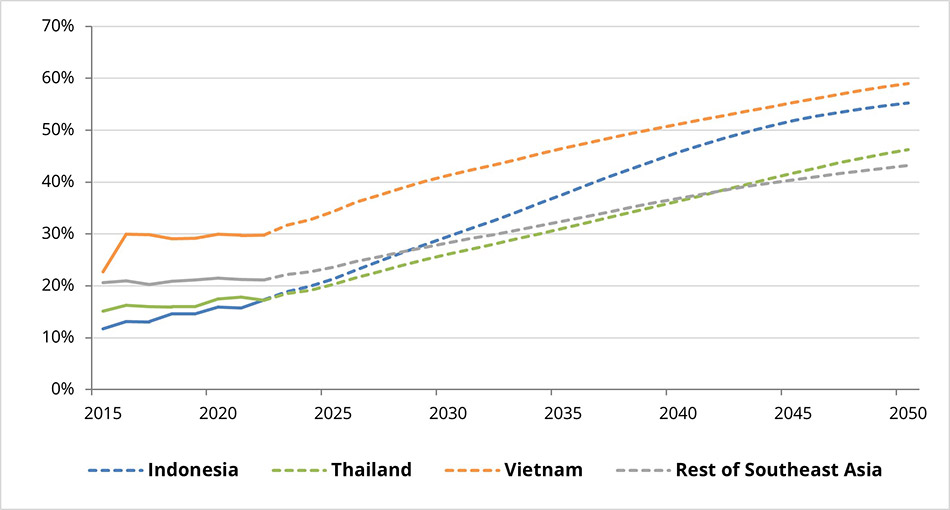

Figure 4: Share of electricity in final energy consumption – EnerGreen scenario

Source: Enerdata, EnerFuture

Figure 4 is derived from Enerdata’s in-house POLES 1 model. According to the EnerGreen 2 scenario, it illustrates that approximately half of ASEAN’s final energy consumption must be fulfilled through electricity by 2050 to comply with a below 2°C warming. This share even approaches 60% in the case of Indonesia and Vietnam. The challenge is thus massive for ASEAN countries since electricity represents only 20% of the energy consumed today, and considering that electrification needs to be achieved through clean sources.

Technical hurdles

ASEAN Power Grid encounters several technical challenges as the region is composed by multiple islands. Challenges ahead include establishing submersible lines between Singapore and several areas, such as Sumatra, Kalimantan, Sabah, Sarawak, Brunei, and the Philippines (red coloured on Figure 3). Integrating Indonesia and the Philippines to the grid necessitates extensive undersea infrastructures. Overcoming technical challenges, such as deploying high-voltage lines and upgrading transmission grids to accommodate variable renewable energy is also crucial. Due to their intermittent nature, it is more complicated to integrate these sources into traditional power systems while maintaining a reliable supply of electricity. Indeed, the APG extension plan is an important feature for energy security and transition in ASEAN, provided that it operates with carbon-free energy. Although the available technologies are mature, the ability to surpass these obstacles in a short-term frame remains uncertain. Digitalization and the development of smart grids are also important pillars of the extension plan for that matter.

Costs, regulation, and institutional framework

The journey towards building an institutional framework for electricity market across ASEAN involves revising national regulations to encompass cross-border licensing, ensure fair network access, foster competition in power generation, and address import tariffs. For instance, Singapore's initial hesitance to join the Lao PDR-Thailand-Malaysia trading arrangement stems from concerns about its competitive wholesale electricity market and committing to fixed supply quantities. Resistance from well-established utilities, particularly state-owned entities like those in Indonesia, adds complexity to integration efforts. Some stakeholders, backed by substantial lobbying power, may hinder regional integration, and complicate the institutional framework. Hence, significant reforms within key countries are critical to prepare state-owned utilities for cross-border competition if the market boundaries open.

Furthermore, there is a necessity to upgrade existing institutional capacities or establish new centralized entities. However, this endeavour demands considerable resources and a high degree of harmonization. The financing and cost-sharing aspects concerning the ASEAN Power Grid connections and infrastructures also remain unclear. While aligning cost-sharing with each party's net benefits appears reasonable, quantifying and reaching agreements on these aspects is usually another story.

Environmental issues

Building renewable capacities and enhancing connectivity under the APG initiative is subject to environmental concerns. Like the geographical obstacles for transmission lines, renewable power must be deployed where it is the most efficient, while considering the climate and the environment. The wise selection of sites for power plants and grids is key since the ecosystems in ASEAN are very fragile. The whole complexity lies in fairly valuing the energy potential while weighing environmental consequences. This statement applies to all renewable energies or connectivity projects, especially concerning hydropower infrastructures in the case of ASEAN.

The over-damming of rivers, notably the Mekong, has already resulted in detrimental effects on climate, ecology, agriculture, fisheries, and the communities along the riverbanks. Cambodia has taken a significant step by declaring a halt to all Mekong River dam construction due to ecological worries. Similar concerns exist in Lao PDR, Myanmar, and Vietnam. Excessive damming of the Mekong poses risks such as causing floods and droughts, reducing river sediment, impacting agricultural lands, and necessitating the relocation of riparian communities.

KEY TAKEAWAYS

- Southeast Asia experienced robust economic growth but largely rely on fossil fuels constituting 80% of primary energy consumption.

- Electricity consumption is soaring, while renewable energy shows a very high potential. Hydroelectricity is a very important resource in the Mekong countries. Solar capacities are growing very fast, especially in Vietnam for the past 5 years. Geothermal and biomass resources also play an essential role in Indonesia, Thailand, and the Philippines.

- ASEAN countries have diverse electricity market structures, ranging from centralized state-owned utilities to competitive markets, which complexifies cross-border integration.

- The ASEAN Power Grid initiative aims to enhance energy security through cross-border power grid connections, although challenges persist due to differing readiness levels among states. The extension plan is oriented towards more integration to move from bilateral trade to an interconnected network.

- The APG plays an important role in energy transition and power supply as it allows to fully benefit from electricity production where it is the most efficient. As electrification is crucial for decarbonisation, connectivity between ASEAN countries makes renewable sources more profitable.

- Electricity market integration faces numerous challenges. Technical feasibility, regulation, cost-sharing, or environmental concerns needs to be addressed. Nonetheless, it turns out that the upcoming years are promising to bring the APG forward to its full potential.

Notes:

1 POLES is a world energy-economy partial equilibrium simulation model of the energy sector until 2050, with complete modelling from upstream production to final user demand and greenhouse gas emissions.

POLES model: Global energy supply, demand, prices forecasting model. (enerdata.net)

2 EnerGreen explores the implications of more stringent climate policies, with countries fulfilling or overachieving their NDC commitments. These changes lead to significant improvements in energy efficiency and a strong deployment of renewables. In this cleaner trajectory, global temperature increase is limited to well below 2°C.

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis