Global energy-related CO2 emissions still rising in 2019

Get this executive brief in pdf format

This month, we analyse our preliminary global CO2 estimates for 2019 based on monthly data. The CO2 estimates and CO2 emissions presented in this executive brief are derived from energy-related CO2 emissions from Global Energy and CO2 data and energy-consumption data from EnerMonthly. This brief has been prepared by Enerdata’s Data and Research team.

Content

- Key takeaways of 2019 trends

- Key figures from fossil fuels consumption and related CO2 emissions evolution

- Evolution estimates for the 3 largest emitters: China, the USA and the European Union

Key takeaways

- The global CO2 emissions from energy combustion should grow by +1-1.5% in 2019, driven by an increase in energy consumption.

- Fossil fuels consumption is growing by +1.5-1.9%, with a significant increase in gas (+4.7%), gaining market share, while coal is slightly decreasing following two consecutive years of increase, but to an extent that depends on uncertainties in Chinese data. Oil continues to grow (+1.7%).

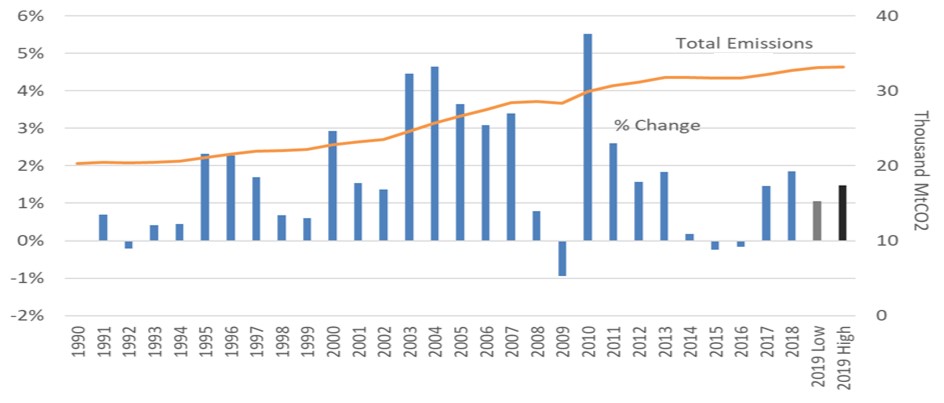

Figure 1: Global energy-related CO2 emissions

Source: Enerdata, Global Energy & CO2 Data and EnerMonthly

Natural gas satisfies a major part of the additional energy demand in 2019

Natural gas is the main beneficiary of the energy demand growth, its consumption rising by 4.7%, continuing the same trend as in 2018. Such growth is mostly imputable to large increases in the US (abundant and cheap supply), China (gas gaining market shares over coal), and Russia.

Oil consumption continues to grow, up 1.7% compared to 0.9% last year, supported mostly by captive consumption in transportation and for petrochemicals. China (+8%) is the largest contributor to growth. Conversely, Europe is set to record a decrease in oil consumption for the second year (-1%).

A key turning point comes from coal, the consumption of which will decline in 2019 (by 1.3% in the low estimate), a significant change from the 0.8% growth in 2018. Overall, the US and Europe contribute the most to this decline (-9% and -5%, respectively), despite growth in China and India. As the world’s largest emitter from coal, China has a big effect in determining the magnitude of this decline, due to uncertainties over its coal production.

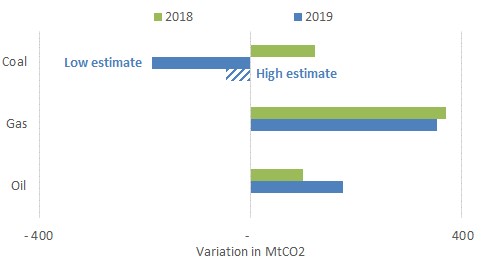

Figure 2: Variations of global CO2-emissions

Source: Enerdata, Global Energy & CO2 Data and EnerMonthly. Note: Low and high estimate ranges are based on the growth in emission from coal in China (between 1% and 2.5% respectively).

US emissions will decrease slightly in 2019

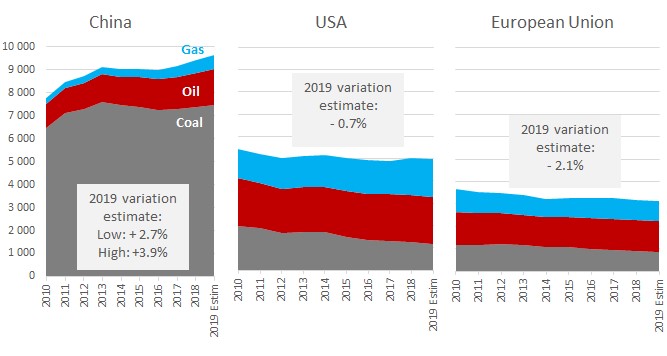

Looking at the top three emitters in 2018 (China 29% of world CO2 energy related emissions in 2018, US 15%, EU 10%), the biggest change in 2019 compared with observed trends in 2018 will come from the US with a drop of 0.7% (vs. +2.8% in 2018).

This is primarily related to a drop in coal consumption (-9%) led by the power sector as coalfired power plants are increasingly replaced by cheaper, and cleaner, gas-fired generators, aided by the shale gas boom, and renewables.

Despite this expansion of gas use, the increase in gas consumption in the US will be lower than in 2018 (+4% compared to +11% in 2018). Oil consumption sees a slight increase (+0.6%) supported by demand from a stable petrochemical industry.

China’s infrastructure boost pushes emissions upwards in 2019

Following a similar trend to past years, China will post a 2.7% energy-related emissions growth in 2019 (+3.9% in our high estimate). This is largely due to an appetite for the dirtiest fuel: coal, which is available cheaply locally, and makes up 77% of total Chinese emissions.

This year, however, has seen newfound demand for the construction sector (steel, cement, glass) as the demand of infrastructure and real estate take the lead from power generation, whose demand for coal has stagnated as cleaner sources such as gas and renewables satisfy any additional demand.

China also stays the largest importer of oil in the world. Oil consumption will also see growth (+8%) despite uncertainty over trade talks with the US.

Natural gas, the smallest contributor to overall emissions but the one with the highest growth compared to coal and oil, would grow by 11%. This follows a trend of continued growth over the last few years, with a government push to increase its consumption aided by increasing imports of liquified natural gas (LNG).

Emissions in the EU continue to decline in 2019

An increasing effort to decarbonise the continent has seen fossil fuels decline in their usage with consumption from oil and coal decreasing (-1% and -5% respectively) whilst gas remains stationary. This leads to an EU-wide decrease in emissions by around 2%.

Coal is gradually being pushed out of the system, particularly in the power sector, where increasing carbon prices in the European Emissions Trading Scheme (EU ETS, €25/t in November 2019) plus other influencers such as coal phase out policies put a preference on cleaner options such as gas and renewables.

Figure 3: CO2 emission profiles of the three largest emitters

Source: Enerdata, Global Energy & CO2 Data and EnerMonthly. Note: 2019 variation relative to 2018.

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis