Global LNG industry is undergoing fast changes in terms of both supply side and demand side dynamics. Driven by the technological innovation like horizontal fracturing, supply of LNG is poised to increase substantially after 20181 . On the demand side, massive increase in the energy requirement of emerging nations and strict environmental regulations are pushing the natural gas consumption forecast to higher levels. The increase in natural gas demand will directly affect the development of small scale LNG.

This article presents an analysis of the different factors that can affect the development of small scale LNG and identifies the possible challenges for the small scale LNG industry.

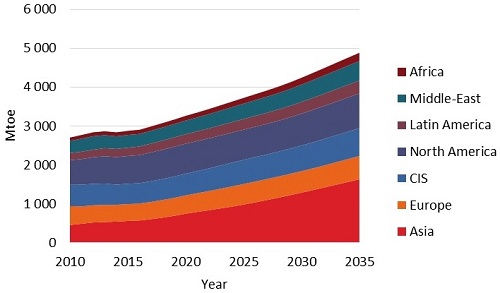

Figure 1 shows the natural gas demand forecast for different regions of the world. The projections are based on Enerdata in-house POLES model and are shown for the Balance scenario which assumes that current policies and growth trends will continue for the forecast period. The total consumption is expected to increase by 71% from 2,900 Mtoe in 2013 to 4,950 Mtoe in 2035. Major increase will come from the emerging economies of Asia whose share increases from 18% to 33% of the total global demand for the period 2013-2035. Asian demand grows from 530 Mtoe in 2013 to 1,630 Mtoe in 2035 which represents an increase of over 200%.

Figure 1: Natural Gas Demand Forecast

Source: Enerdata, Balance Scenario of the POLES model

Trends in the demand growth will determine the future of small scale LNG. Small scale LNG refers to liquefaction, transport and regasification of LNG for small end uses like heavy road transport, bunkering and small industrial processes. International Gas Union (IGU), an organization to promote the use of natural gas, defines small scale LNG as the liquefaction and regasification plants with a capacity of 1 MTPA or below.

Also, LNG carriers with a capacity of below 18,000 cubic meters are categorized under small scale LNG. The business case for small scale LNG rests on a number of economic and regulatory factors.

Economic factors include the fuel price differentials, availability of gas supply and increase in demand that will determine the growth in global LNG trade. The use of LNG in markets like heavy trucks depends on the price differential between LNG and other alternatives like gasoline. Higher oil prices are required to make a profitable switch to LNG in road transport.

In the case of US, increase in gas supply has played a key role in increasing the market penetration of LNG for small industrial users. Small scale LNG also seems to be a suitable option for small emerging markets of South-East Asia. For countries like Indonesia, small scale LNG offers a way to overcome the hurdles presented by its dispersed landmass. Regulatory factors include emission regulations and government support for LNG projects. The emissions from natural gas are substantially lower than from oil. China is playing an active role in increasing the market penetration of small scale LNG. The CO2 emissions in China grew from 8,200 MtCO2 in 2010 to 9,700 MtCO2 in 20132. Chinese government is investing heavily in building the required infrastructure for heavy LNG vehicles. More strict sulphur emission regulations in the Annex VI of the MARPOL are expected to provide a significant boost to LNG bunkering after 20153. The European Union (EU) has commissioned a study under the name of ‘LNG Blue Corridors’ to identify possible roadmaps for adoption of LNG in heavy transport.

Under the study, LNG stations will be built and a fleet of LNG heavy vehicles will be set up to study the LNG market development for road transport4. One of the challenges that the small scale LNG industry is facing belongs to the traditional ‘chicken and egg’ problem. Developing the industry requires investment in infrastructures but the lack of infrastructures makes the demand for LNG uncertain and it brings an element of risk for the project investors.

Another challenge for the industry is different economics of the small scale LNG supply chain as compared to the traditional big volume LNG supply chain. Small scale LNG liquefaction and regasification plants have different project economics. For example, a developer in the small scale liquefaction plant will not be able to gain from economies of scale that exists with large volume projects. Uncertainties in the economic and regulatory factors discussed earlier bring additional challenges for market players in the small scale LNG industry. The different nature of small scale LNG supply chain as compared to the traditional large scale LNG supply chain suggests that new business models are needed for players in the small scale LNG market. Due to the dynamic nature of LNG industry, more research is required to make a successful business case in the small scale LNG segment.

Notes:

- 1 Enerdata analyst estimates

- 2 Enerdata Global CO2 database

- 3 International Maritime Organization (IMO), http://www.imo.org/OurWork/Environment/PollutionPrevention/SpecialAreasUnderMARPOL/Pages/Default.aspx

- 4LNG Blue Corridor Project, http://www.ngvaeurope.eu/lng-blue-corridors

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis