As part of our forecast model services, Enerdata presents its future R&D developments for the forecasting model related to electricity price in Japan. Due to high volume of expensive LNG imports, Japanese utilities companies are facing difficult times. The share of different energy sources in the power generation mix has been completely reshaped after Fukushima with an increase in thermal generation and decrease in nuclear generation that has affected the electricity price. The Enerdata Forecast Model predicts within a very narrow range the electricity price and the model key input variables are fuel mix, fuel prices, GDP per capita, Energy Policies and technology improvement. Lately we have started a R&D work to include two new additional input variables that will start to affect the final electricity prices considerably. The first is “Renewables share” in the Japanese generation mix because it is expected to reach 10% in the near future. The second is “liberalization in the electricity sector” which aims to increase competition in the electricity market. Our model aims to provide accurate forecasting of the electricity prices in Japan which will assist the different market players to understand the new dynamics of the price structure and support effective business decisions.

Enerdata modelling framework for electricity prices

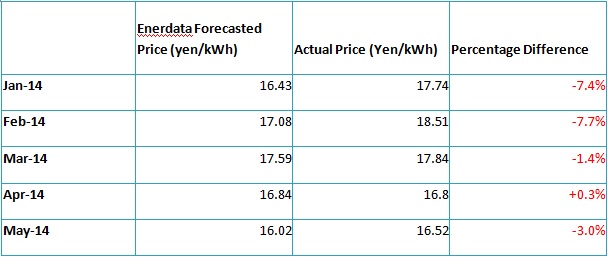

54 nuclear reactors were in operation across 17 plants in Japan before 2011. Nuclear share as the percentage of total generation fell from 25% to almost 1%t in just a span of a year due to the Fukushima disaster. This led to a marked increase in thermal power generation. In 2013, the share of gas in power generation was 54% higher as compared to 2010. Enerdata analysed the electricity prices for industry in Japan from 1994 to 2013. To identify the drivers of electricity price levels using empirical data, we used advanced econometric techniques and selected the most significant variables that affect the electricity price. The factors that were used as an input to the model are: gas import price, coal import price, oil import price, share of different fuels like gas, coal, oil, nuclear and renewable in the power mix and GDP per capita. Japanese power mix is quite balanced in terms of fuel share. In 2010, thermal generation accounted for approximately 65% of the total power generation, nuclear was 25% and renewables (including hydro) represented the rest of the share. However, in 2013, thermal generation was 89%, nuclear was just 1% and renewables around 10%. Parameters that changed significantly from 2010 to 2013 are the share of thermal and nuclear generation. We constructed a fuel price index as the weighted sum of the fuel price (natural gas, coal and oil) with their respective shares. Nuclear was not included in this index as we wanted to model the effect of the decrease of nuclear share as a separate variable. From preliminary analysis, we found that the share of renewable did not affect the electricity price and hence we removed it from the final model that we are presenting in this paper. We also included a trend factor to see if the prices show any general systematic variations over time. Table 1 shows the comparison of actual prices and our model forecasted electricity price from January 2014 to May 2014. The forecasted prices are found to be close to actual prices and the mean percentage error for the five months is just 5.2%. This shows the accuracy of our model.

Table 1: Comparison of Enerdata model forecast and actual electricity prices (Jan 14 – May 14)

Source: Enerdata Forecasting Model

Liberalization in Japan and increase in renewable share

The Amended Electricity Business Act was adopted in November 2013 in Japan that aims to restructure the electricity industry in Japan by establishing a new regulator by 2015, fully liberalizing the retail market by 2016 and unbundling the power transmission and distribution sector by 2018-2020. The Strategy Energy Plan of Japan aims to increase the share of renewables to 10% of total power generation. According to Enerdata Global Energy Database, renewables accounted for 5% of the total electricity generation in 2013. Biomass and Solar are the two fastest growing renewable energy sources in Japan. Over 2008-2013, generation capacity of solar increased at a CAGR of 16% whereas the corresponding figure for biomass was 11%. Electricity industry players in Japan need to equip themselves with appropriate tools that can help them in facing the changing scenarios due to increase in competition and changing fuel mix due to increase in renewables and uncertain nuclear strategy. Our model can provide crucial inputs for such requirements. If you wish to receive the complete article and want to talk more on the forecasting model and Enerdata Gas and Power Services, please contact us at asia@enerdata.net.

Energy and Climate Databases

Energy and Climate Databases Market Analysis

Market Analysis